We all experience loss in our lives, and dealing with grief while also honoring and remembering our loved ones can be incredibly challenging. Particularly around the holidays, those who were closest to us who have passed on are often at the forefront of our minds.

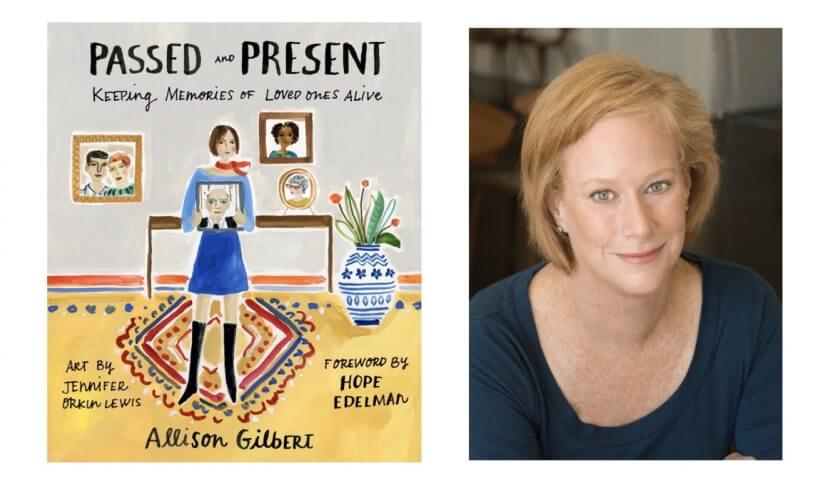

This week, Jean sits down with Allison Gilbert, an Emmy-award winning journalist, and the author of “Passed and Present: Keeping Memories of Loved Ones Alive.” Her book has been described as a “how-to” manual for remembering our loved ones, and contains 85 practical ways to remember, honor, and celebrate those who have passed. “There is more that we can do than just going to a cemetery or lighting a candle,” Allison says, adding that she wanted to find a way to make her parents real for her two children who didn’t have their maternal grandparents. “I wanted them to truly understand and value and appreciate all those things that came from the Gilbert family,” she says.

Allison walks us through how we can all take ownership of ensuring our loved ones’ memories live on in perpetuity. She also talks about how we can be an awesome friend and coworker to people who have lost loved ones, when we just aren’t sure what to say. (She also includes ideas for special remembrance gifts, which we all need!)

Allison also shares why the way we talk about our late loved ones matters. “When I’m speaking to my children, I never say ‘my mom’ or ‘my dad,’ I will always say ‘your grandmother’ and ‘your grandfather,’ because it orients that relationship to them, and makes it more tangible to what they would have missed,” she says.

Jean and Allison also talk about all of the baggage, stuff and money that’s often associated with death, and the ways that people can best deal with it. (Hint: Nothing has to be done today, tomorrow, or even the next day after a loss… You can have some breathing room and wait six months before you do anything.) In other words, you don’t have to wake up and immediately sell the house. Rather, you can wait until the emotions aren’t so raw. You can take a breath and then bring in an advisor (a financial advisor, a trusted friend or family member) who is more neutral and who can help you think about next steps and perhaps purging your loved one’s goods over time.

Allison also breaks down a guide for how to repurpose and donate your loved one’s possessions, and how to make giving things away a less guilt-ridden process. She also offers up her thoughts on how to make it easier for our own children and grandchildren to deal with our “stuff” and to remember us after we’re gone. Thankfully, the digital world has changed the game when it comes to remembering. It’s easier than ever to share stories in a family Google doc, upload and digitize photos, and share memories — it’s no longer the responsibility of one family member to be the repository of the entire family history.

Then, in Mailbag, Jean advises a woman going through a divorce on whether to keep saving or pay down her debt, since she will likely be splitting assets and liabilities evenly with her husband. She also guides a listener who’s considering refinancing her home loan but is unsure if it’s worth the time and effort to save half a percentage point, and offers her thoughts on getting a prenup to a woman who’s engaged to a man who has a strained relationship with his children. Lastly, in Thrive, Jean dishes on how to retain your sanity and energy levels when pursuing a side gig.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Jean Chatzky: (00:07)

HerMoney is brought to you by Fidelity Investments. We want you to feel confident about investing so that you can make your money work just as hard as you do. Learn the ropes without the jargon at fidelity.com/demandmore. HerMoney comes to you through PRX. Hey everybody, it’s Jean Chatzky. Welcome to HerMoney. Thanks so much for joining me today. I have been talking a lot lately about Women With Money, my most recent book, but as we were pulling together today’s show, I went back, I flashed back to the research because one of the things that I did when I was trying to figure out what actually belonged in that book was just ask a whole bunch of women, hundreds of women, what they wanted from their money, and one of the things that I heard again and again and again was this concept of legacy, and that’s a word that means very different things to different people. For some it’s charity. It’s giving to causes that you believe in. For others, it’s instilling values in our loved ones, making sure that they, and we, are remembered when we’re gone. And that active remembering is so important. New data from a firm called Story Terrace shows that just one in three Americans, 34%, which I think is a big number in this case, say that there are heroes in their family that will soon be lost because they’re not being shared, they’re not being talked about, they’re not being documented. Loss is not something we talk often enough about here at HerMoney, which is one reason why I am so happy to be able to welcome today’s guest to the show. Alison Gilbert is an Emmy winning journalist and she’s the author of Passed and Present, P-A-S-S-E-D and Present, Keeping Memories of Loved Ones Alive. Hi Alison.

Alison Gilbert: (02:22)

Hey Jean.

Jean Chatzky: (02:23)

Thanks so much for coming into the studio.

Alison Gilbert: (02:24)

I am so happy to be here.

Jean Chatzky: (02:26)

We’re happy to have you here. Loss has been an ongoing subject for you for at least the past 15, going on 20 years. Can you tell us a little bit about how you got to it?

Alison Gilbert: (02:40)

Yeah. It was very personal. My mother was diagnosed with ovarian cancer when I was pretty young and she died right after college, so I was just beginning to launch into my career. She died when I was 25, so that was before I was married and had kids of my own and really still had all those young adults I’m not yet launched questions for her. And she was a powerhouse. She was a working woman. She owned and operated the largest executive search firm owned and operated by women in the country. And so she was someone who I really admired as a working mom. And so I needed to have this template continue. I wasn’t done. And a few years after that, it really felt like whiplash. My father passed away also from cancer. And so it left me as a young adult, a bit rudderless without my parents as guides. And that’s what started me on the journey of really exploring what this can mean, not just to me, but helping other people make sense of their losses too.

Jean Chatzky: (03:43)

First of all, I’m so sorry. I mean, I think about, my son who’s 25 called me the other night because he was fostering a dog and had decided he was giving up the dog and was taking it to its new home and he was just shaky and he didn’t know if he could do it. And, you know, I was happy to be able to have that conversation with him at that point.

Alison Gilbert: (04:07)

I think there’s always opportunity to impart lessons to our kids. I have, you know, two older teenagers now and I feel like, you know, when they’re 25, like you just said about Jake, I feel like they’re still gonna want to ask questions. I still want to ask my parents questions and I’m almost 50, you know, I don’t think it ends and I think that what we need to do that builds our resilience is imagine, I really think, what would our parents have said and what are the guideposts that they left in their wake. And I really do think that some of the lessons that I’ve been able to use in the silence of my parents today has come from how I can look back and see how they modeled their life as an indicator of what I can be doing or should be doing. And in some times the liberating factor is too how I can do things differently as well. ‘Cause it’s not just rosey right? Sometimes you want to pivot and do something completely different.

Jean Chatzky: (05:03)

I’ve heard Passed and Present described as a how to manual, how to what?

Alison Gilbert: (05:11)

Oh, to remember our loved ones. The reason why I wrote the book and it contains 85 practical ways to remember honor, celebrate, our loved ones really how to do those things. There’s more that we can do than just going to a cemetery or lighting a candle and all those things are great. But I wanted more. And what I mean by that is that it wasn’t just for me, it was how can I make my parents real for the two children who didn’t have their maternal grandparents, meaning my own children. I wanted them to really understand and value and appreciate all those things that came from the Gilbert side of the family and not just my husband’s side of the family and not that there’s anything wrong with my husband’s side of the family and of course they’re listening so I love you so much, but there are different values. There are different qualities and I wanted to make sure those were paramount, as much as I could, as my children were growing and are still growing, so I felt this vacuum of how to make sure that they could know who their maternal grandparents are because it’s not just were, are, they still are their maternal grandparents. I think just that even that quick change of tense, it validates that these relationships are still really important.

Jean Chatzky: (06:33)

When you look at the 85 different lessons, 85 different exercises, which ones emerge as the most effective, which have been the best in terms of helping your kids understand who their grandparents are?

Alison Gilbert: (06:49)

I’m going to answer that with two thoughts. One is that underlying every one of the ideas is this really important message that I hope everyone takes away, hopefully from your podcast, which is that I think there’s something called passive mourning. M, O, U, R, I, N, G. Right? And — with an N.

Jean Chatzky: (07:10)

Throw an N in the middle.

Alison Gilbert: (07:10)

I forgot the N. Where we are generally passive recipients of support, when someone we love passes away, you know, people know to bake a cake or come over if it’s a shiva or a wake, they kind of know how to rally around and give you that scaffolding of support when someone dies. I think what happens later is that that piece of remembering that really is up to you, you can’t be passive anymore. So the real pivot comes to, you have to be active about remembering. So shifting from passive mourning to active remembering. And so the 85 ideas is really about how do you take ownership of making sure those stories endure and how to make sure those memories live on in perpetuity. So one of my most favorite ideas, actually I saw unfold in front of my eyes. I thought it was just so brilliant. After my father passed away and my parents had long been divorced since I was really young, my stepmother got the most incredibly thoughtful gift and this is a great idea. If you’re listening, you haven’t suffered a loss, but you want to be a really awesome friend to somebody else, even a coworker. she got a Wicker basket and inside the wicker basket or 63 daffodil bulbs, because my father was 63 when he died.

Jean Chatzky: (08:32)

Wow.

Alison Gilbert: (08:33)

And so the goal was for, of course, my stepmother to have 63, you know, just celebrations of each year of my father’s life. But it wasn’t meant to be this kind of horrible gift where she had to plant these on her own. Like that would just be like not a nice gift, right. To give someone such a horribly, you know, like a labor filled gift. The goal was to share that process and to invite friends and family over and crack open an opportunity where we can eat, drink, have a good time, plant the daffodil bulbs, and then share stories about her husband, my father in a celebratory way. And I think that’s a great way of sharing stories and making it something that kids want to do, right? And so they feel like they’re learning without realizing that they’re learning at the same time. And it’s kind of hidden within this kind of fun activity.

Jean Chatzky: (09:25)

And I think we have to remember that we have to repeat those stories. That our kids, because they weren’t there, one time, may not be enough. And they like hearing them again. And again. There’s a famous story about my father who passed away about 15 years ago giving my dog a shower. I don’t know what Grover had done, but he had gone out. He had gone out and this, these were in the days I grew up in wheeling, West Virginia. That dog was allowed to just run on the grounds of this big boy’s school that we actually lived on.

Alison Gilbert: (09:57)

And how great that his name was Grover?

Jean Chatzky: (09:58)

You know, that was my father too. ‘Cause when we got him from the pound, I was gonna name him Rover and my father said, oh no, just give him some personality and put a G on there. So he got completely muddy or something and my father put on his bathing suit, got in the stall, shower with the dog and proceeded to like…

Alison Gilbert: (10:20)

I love it.

Jean Chatzky: (10:20)

…give him, give him a shower. And the dog just kept his paws up on the glass door, the entire time, like, let me out. And my kids at their ages now still want to hear that story from my mother. So I think…

Alison Gilbert: (10:36)

Because there’s humor, right? So humorous stories I think make a big difference, right? Things that have, you know, sensory, um, attributes I think get also remembered. Well, but I’ll raise you one story, which is, it’s how we talk also that really matters. And what I mean by this is when I talk to my children about their grandparents, I am very, very much aware of how I talk about them. And what I mean by that is I never say as much as I can, you know, remember to my mom and my dad. I will always say, your grandma and your grandfather because it orients that relationship to them and it makes it more tangible to what they would have missed or what they still have at their fingertips. It makes it really about them. And as we all know, even the kids when they’re really young, they’re self-centered by nature. And that’s not bad. That’s just developmentally. Kids like to do things that revolve around them. So if you can make stories about their grandparents, I think that’s really effective and it’s free. Like, it just, it just makes you choose your language just a little bit differently.

Jean Chatzky: (11:45)

I actually want to turn to the money and the belongings, but before we do that, I just want to remind that HerMoney is proudly sponsored by Fidelity Investments. Fidelity is all about helping you demand more from your money. And one way they’re doing that is by paying you more on your cash. Now at Fidelity, when you open a new retail brokerage or retirement account, your cash automatically goes into a money market fund where it can work harder for you. Just to note, you will get this benefit automatically and your cash goes into a money market fund unless you choose another cash option. For more information and the current rate, go to fidelity.com/cashvalue. You could lose money by investing in a money market fund and investment in a money market fund is not insured or guaranteed by the federal deposit insurance corporation or any other government agency before investing. Always read a money market funds prospectus for policies specific to that fund. Fidelity Brokerage Services LLC. We are back talking with Alison Gilbert, author of Passed and Present. Sometimes when money is passed down, often when money is passed down after somebody dies, there’s a lot of baggage that comes with that money and you either do things that you later wish you hadn’t or you find yourself tied in knots and unable to do anything at all. How did you deal with this and how do you help people deal with this?

Alison Gilbert: (13:22)

I think a really good school of thought that I think many experts agree to is that nothing has to be done today, tomorrow, the next day after a loss. You can really have some breathing room. You can wait 6 months, 9 months, 12 months. It’s really, there’s nothing, the sky is not going to fall. Meaning that if you are feeling overwhelmed by a home and you shared that with your spouse and it’s feeling very emotional, you don’t have to sell it the next day, you can, you know, wait ’till the emotions aren’t so raw. And so I would say the first step is really to just take a breath. You’re going through a lot and the importance of bringing in an advisor, whether or not it’s someone who is related to you or maybe it’s someone you know, you have a financial advisor at Fidelity or you know, an another place. I think it’s really important to bring in some expertise that is really more neutral, who can really perhaps see things with a bigger picture perspective and is not so full of this kind of rush of emotion that we all have after a loss.

Jean Chatzky: (14:28)

Yeah, I agree with that actually. I think getting a little bit of air between what happened and then what you do next is important.

Alison Gilbert: (14:36)

Well one really important thing even about possessions, even clothes, I remember after my mother died, you know I was 25 and my mom was 57 and I just, I at the same time it sounds like really kind of a conflicting thing and it was, that’s why it was so hard. I wanted to keep her entire wardrobe and you know, have her clothes and have her dresses and have her scarves. But I was a 25 year old woman then dressing up as a 57 year old woman. I mean it’s kind of like looking back now, I was stuck and I did start keeping a lot and then over time started really being able to purge and I think that having the goal of over time, whittling things down was much more calming to me than having to give everything away all at once. It felt like I was being stripped of these linkages to my mom.

Jean Chatzky: (15:33)

Can I confess something?

Alison Gilbert: (15:35)

Yes.

Jean Chatzky: (15:35)

So I said my dad died 15 years ago and my mother she had his suits, and he was a real, he loved clothes. Oh my God. And he was a great dresser and my mother had his suits and ties and things like that for about two years and then she just couldn’t do it anymore. They’re now in my house and I can’t…

Alison Gilbert: (15:57)

All of them?

Jean Chatzky: (15:57)

I can’t get rid of them.

Alison Gilbert: (15:58)

You know what I did with my dad’s ties? My dad was also a dapper dresser. He was an architect and so he was all about style. So I took all of his ties where he had hundreds of them ’cause that was, like, his calling card. And I am not Martha Stewart. I am not very talented, but I know where to go to get these things done. I had his ties turned into a quilt.

Alison Gilbert: (16:19)

Oh wow.

Alison Gilbert: (16:19)

By a quilter. And so when my kids were really young, I could point to patterns or textures or colors and I could remember in very, very small fragments, stories that I remembered their grandpa wearing that tie. And over time the stories can get more elaborate. So yeah, you can always do fun things with these possessions.

Jean Chatzky: (16:36)

I love, I actually love that idea because, although my husband, when we got married, he wore one of my dad’s ties and…

Alison Gilbert: (16:45)

Aw, I love that.

Jean Chatzky: (16:45)

And when Jake was bar mitzvah’d, he wore one, but nobody wears ties anymore. So they’re just hanging in the closet.

Alison Gilbert: (16:52)

Well, you know, there’s a whole chapter in past and present called repurpose with purpose. And this is like my Marie Kondo chapter, right? Which is very much, you know, possessions can weigh us down and there’s liberation in really either repurposing or getting rid of. To get rid of something feels like a drain. And you feel guilt if you give things away to a museum or a historical society or a VFW or someone’s, you know, school and then you can make those possessions that you no longer want meaningful in that story of your loved one, but somebody else will value it, I think that’s a really great opportunity.

Jean Chatzky: (17:32)

Yeah. I’ve been thinking about the suits and trying to find some costume shop that would like them. Right.

Alison Gilbert: (17:39)

That’s a great idea!

Jean Chatzky: (17:39)

Because I mean they, at this point, they’re 15 years old, they belong in Guys and Dolls.

Alison Gilbert: (17:45)

I was going to say or it can be a high school theatrical production. You know, it’d be a wonderful way of going back to even your, your dad’s high school and making the contribution because they of course had a tidier dad even differently than you did. So it’s a way of also reopening conversations with people who actually remember your dad and value his memory and how can you do that? And it makes giving things away less guilt-ridden.

Jean Chatzky: (18:08)

Absolutely. I want to just flip the equation in the few minutes that we have left. How do we at this point make it easier for our kids and our grandkids to deal with our stuff and to remember us?

Alison Gilbert: (18:23)

Well, I think it’s really interesting. I think that there is this narrative that we don’t tell stories and that things are you know, recollections of our ancestors or even more current loved ones are harder to make stick with our families. And I actually think that there’s a counter narrative. I think that with digital media, you know, with social media, with the ability to digitize photographs, it’s actually more easy than ever to share these stories. And here’s just one quick example. If you and your family got together and had a Google Doc and you can all share recipes about, you know, a family recipe that you all don’t want to forget, you guys don’t have the responsibility of one family member being the repository of family history. Now you can share it if you just have their email address.

Jean Chatzky: (19:10)

Wow, I love that.

Alison Gilbert: (19:12)

So it’s just a matter of like, how can we use what we do anyway? How can we use Facebook? How can we use Instagram? How can we use social media to our advantage? I was going through some photographs of my father and I found one where he was at a wedding, you know, a really long time ago when he was a young man and I’m like, gosh, that looks so familiar. Where does that picture, what does that remind me of? And my son had just gotten his driver’s license and he made a really silly face. And I mean it’s silly on his, on his license photo. And I’m like, Oh my God, that’s his grandfather. And I just used Photoshop and I put the two pictures together so my son could see for himself those physical traits that I see as being the linkages between the generations. But now my son can see it for himself. So how can you use the technology that we have to make these connections stronger? And I think it just takes, again, going back to how we first started, what is our role now? It’s to be proactive. So how can we use our phones to snap a picture that’s in our photo albums and then obviously upload that to Facebook and and invite comments. Ask your family who don’t even live near you too. What’s your memory of this particular occasion?

Jean Chatzky: (20:23)

Amazing. Alison Gilbert. The book is Passed and Present and you can learn more about Alison at alisongilbert.com. Thanks so much for doing this.

Alison Gilbert: (20:32)

What fun. Thank you so much Jean.

Jean Chatzky: (20:34)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (20:40)

Kathryn Tuggle from HerMoney.com has joined me in the studio. How are you?

Kathryn Tuggle: (20:45)

Great, how are you?

Jean Chatzky: (20:46)

You look so holiday-y today.

Kathryn Tuggle: (20:48)

It’s so funny, Becca just told me that I needed to wear this to a holiday party, but now I think II’ve already ruined it ’cause I’ve already worn it.

Jean Chatzky: (20:58)

No, I think you absolutely. First of all, we are not the Instagram generation. Like, I am not going to say anything and neither are any of your colleagues, right. If you would rewear things. But it’s all about the lipstick. The lipstick with the dress is just perfect.

Kathryn Tuggle: (21:14)

Thank you. The lipstick was tough for me. I don’t usually go this red.

Jean Chatzky: (21:17)

It’s very red. It’s very beautiful.

Kathryn Tuggle: (21:19)

Thank you.

Jean Chatzky: (21:20)

You’re welcome. Are you having a good week? Kathryn was on jury duty this week.

Kathryn Tuggle: (21:26)

I was.

Jean Chatzky: (21:26)

But it only lasted four hours. So what did you do to…

Kathryn Tuggle: (21:31)

It was amazing.

Jean Chatzky: (21:31)

Share please.

Kathryn Tuggle: (21:32)

It was just the luck of the draw. We just sat there all day, but I was ready to make excuses, be twitchy. I was going to do whatever I had to do to get into the studio today to produce these shows.

Jean Chatzky: (21:45)

I think the key, at least I’ve been told, because my jury duty experience has been very similar to yours. I do get called, but I usually am there one day or two days and then get, I’ve never actually gotten on a jury.

Kathryn Tuggle: (21:58)

Last time I got pretty far down the road.

Jean Chatzky: (22:00)

You did?

Kathryn Tuggle: (22:00)

We were in the courtroom doing the selection process and then the case that I was attached to ended up settling. So I was a little worried.

Jean Chatzky: (22:09)

Yeah. But I, I’m told if you have big opinions that can work in your favor.

Kathryn Tuggle: (22:15)

Yes.

Jean Chatzky: (22:15)

Big loud opinions.

Kathryn Tuggle: (22:16)

I Googled the night before how to get out of jury duty and some of the suggestions were awful.

Jean Chatzky: (22:22)

Really?

Kathryn Tuggle: (22:23)

Yeah, I was like, I’ll go up to a certain point, but you know.

Jean Chatzky: (22:27)

I just figured if I was coughing and sneezing on my neighbors, that would be bad too.

Kathryn Tuggle: (22:31)

Well, I feel like I probably contracted the flu in this room. There was a woman who just draped her entire coat over her head, so.

Jean Chatzky: (22:40)

Well, we are very, very glad to see you.

Kathryn Tuggle: (22:43)

Thank you. Alison was great.

Jean Chatzky: (22:44)

Yes, she really was. You know what’s so interesting in listening to her is I think my mother does so many of those things just naturally. Like she has always said, your grandmother, your grandfather, not my father. You know, she’s always, she’s always telling stories. She’s put stories down on tape so that they’re there for the great grandchildren to listen to. I’ve done none of this, none of this. So I have to get my act together.

Kathryn Tuggle: (23:14)

I mean, your kids know their grandparents though.

Jean Chatzky: (23:18)

I don’t think my daughter remembers my father very well. She was very young when he died. And Jake remembers. And Jake has good memories and I have tried to keep a lot of pictures of them with my father around, but I need to tell more stories, clearly.

Kathryn Tuggle: (23:37)

We all do.

Jean Chatzky: (23:38)

Yeah, absolutely.

Kathryn Tuggle: (23:39)

Growing up in the South, there’s such a rich history of oral tradition down there. I feel like I know so many stories of people who were around in the 1800s but they’re just quick glimpses. Right. If you really want to paint a picture of somebody and who they are, you have to go into a lot of detail. You have to write it down.

Jean Chatzky: (23:58)

Yeah. I suspect you’re really good at this though, because one of the things that I learned about you when we first started working together is that you write letters.

Kathryn Tuggle: (24:08)

I do. I keep the post office in business.

Jean Chatzky: (24:10)

Yeah. Yeah. And you write letters to people just so they get letters.

Kathryn Tuggle: (24:14)

Well, it started when I was in college. My grandmother, my mom’s mom, couldn’t hear very well. So the phone was not always a great option. And of course she didn’t do email. So the only way to really reach her was via post. So I started sending little postcards, the kind that you see for free at the counter at a cafe or for free at a restaurant.

Jean Chatzky: (24:37)

Yep.

Kathryn Tuggle: (24:37)

Just whatever could find that jot or a little note. And I knew that she loved getting the postcards ’cause she would always comment on it and everything. But when she passed, and I’m going to try not to cry, I found a huge binder of all the cards I had ever sent her under her bed. And the binder she had titled Travels with Kathryn.

Jean Chatzky: (25:01)

Oh my goodness.

Kathryn Tuggle: (25:02)

Because she felt like she had been there with me everywhere I had ever been from where I had sent her all these postcards and…

Jean Chatzky: (25:09)

What a gift.

Kathryn Tuggle: (25:12)

After that, I just started sending them to everybody, to all the little old ladies in my life, to my friends. Now I send some to my friends’ kids because when we go to the mailbox, it’s just bills and just catalogs and junk. And when you see a little handwritten envelope in there, it brings you so much joy.

Jean Chatzky: (25:31)

Yeah. Amazing. Amazing. I hope you save that binder forever.

Kathryn Tuggle: (25:35)

I did.

Jean Chatzky: (25:35)

Absolutely. All right. Speaking of mail, what do we have?

Kathryn Tuggle: (25:40)

Our first note comes to us from Amber. She writes, I’m 32 years old and going through a divorce. We have two small children and we own a house which is currently on the market. We’re hoping to walk away with $3,000 each from the sale of the house after all is said and done. My personal debt includes an auto loan with a balance of $5,000 at 2.94% and a student loan with a balance of $2,600 at 5.25% my husband carries credit card debt and recently bought a new truck. I do not have the numbers on his debt. I have three retirement accounts and he does not have any. I make $42,500 a year and he makes $36,800 a year. My credit score is 782. Would it be best for me to prioritize paying down my debt or saving? I’m hesitant to say it because our state will split our finances equally. Please help and thank you so much for the content you put out.

Jean Chatzky: (26:33)

So Amber, you need to have more information than you have. I am so sorry that you’re going through a divorce. I know what that’s like. It’s awful, especially with young kids, but because the state is gonna split your finances equally, they’re also going to split your debts equally and your retirement accounts equally. At least that would be my best guess of it from my, not legal, but previously divorced perspective and so you need to know what you’re looking at when you say that your husband carries credit card debt and recently bought a new truck. If he’s going to keep that truck, then it will likely be his responsibility to pay it off, but if this credit card debt is debt that was incurred while you guys were married, it’s very possible that they say that half of that debt is yours to pay off and so I really do want to know what you’re looking at. Based on your own debts, I would absolutely prioritize saving because the interest rates on your debts are really, really low and with your credit score, if you wanted to reduce the interest rate on that student loan by refinancing, you probably could very easily do that. But what, it doesn’t sound like you have is much of an emergency cushion and when you go to rent your next apartment, when you go to set up utilities, when you go to put the holidays together for your kids, you’re going to need some cash and $3,000 from the sale of the house is not enough to build a new life on. So, I would prioritize saving at this point. I think it’s great that you are continuing to put money in your retirement accounts, but I would just pay these debts off over time because the interest rates are so, so low and good luck. Let us know how it goes.

Kathryn Tuggle: (28:32)

Yeah, definitely. Our next note comes to us from Callie. She writes, I’m 37 married and live in Austin, Texas.

Jean Chatzky: (28:39)

Lucky girl.

Kathryn Tuggle: (28:39)

My husband and I bought our home in 2018 and have an interest rate of 4.5% on a conventional 20 year loan. That was good at the time, but possibly not the greatest deal. With interest rates dropping, I’m wondering if we should refinance specifically to lower the interest rate we pay right now our monthly mortgage payment is right in our budget. The only new details are that whereas before I made nearly half of our joint income. I have since become a stay at home mom. However, my husband has received a significant raise and we have a very healthy savings rate with very little other debt. We paid off our car and sold an investment property we had a mortgage on. Would it hurt to shop around for a refinance? Would it be worth it to save about half a percentage point given the effort and fees?

Jean Chatzky: (29:23)

I think it’s absolutely worth shopping around and the basic rule, Callie, is that if you think you’re going to be in the house long enough so that any fees that you pay are made up for by the money that you save over the next couple of years, then refinancing is something that you should absolutely consider. I don’t know, however, that you necessarily have to go through a full refi. You bought your home in 2018. It’s 2019 now. If you go back to your prior lender and ask about a loan modification rather than a full refi, they may still have all of your paperwork in place and have everything so together that you may be able to just do it again relatively quickly. So I would look at a loan modification first. If that’s not possible, refinancing is probably a good move. You’re going to have that loan for another 20 years, 19 years doing it at 4% rather than it four and a half percent sounds pretty good to me.

Kathryn Tuggle: (30:40)

Our last note comes to us from Dee. I’m a 57 year old woman with three grown kids and have recently gotten engaged in, purchased a house with my fiance. My question concerns life insurance and retirement accounts. His retirement was cut in half due to a divorce. We both have insurance through work at one and a half times our salaries and between us, we have around $700,000 saved for retirement. My fiance is asking about what will happen to this money if one of us dies. I would like to give my kids something and I have a great relationship with all three of my children. However, my fiance’s only on speaking terms with one of his children, his daughter, and his two sons say they want nothing to do with him. How can we leave our money to our children in a way that is fair without causing a strain on our relationship? I raised my children as a single woman alone for most of my adult life and I want to show my kids it wasn’t for nothing.

Jean Chatzky: (31:30)

So, you need a prenup. And I, it sounds like you’re heading very, very quickly toward the author and toward commingling your financial life because you have purchased the house, Dee, and congratulations on that. But I don’t know, of that $700,000, how much is yours? How much is his? It’s not ours. At least it’s not ours quite yet. And you really should put some legal protections in place so that if half the money is yours, whatever is left at the point where one of you does die is preserved for your kids. Or that you set it up in some other way that is equitable based on the assets that both of you are bringing to your relationship. I hear a lot of heel dragging when it comes to the topic of prenups. People think they’re difficult. They think they’re really, really expensive. They think they’re going to cause problems the relationship. I have one, I got it when I got married for the second time. My mother has one, she got it when she got married for the second time. They are so not a big deal. So call your divorce attorney, divorce attorneys, or if he’s, assuming you still like your divorce attorney, have him call his divorce attorney and just get one of these before you get any closer to the altar, then you can just put it in a drawer and forget about it. What I don’t want to see happen is for your kids to be fighting with him, should you die, or his kids to be fighting with you, should he die, because we all know that even kids who say they want absolutely nothing to do with us probably will want something to do with our money. And so just put this down on paper, get it taken care of and then you don’t have to worry about it anymore.

Kathryn Tuggle: (33:38)

Fantastic.

Jean Chatzky: (33:39)

Thank you so much Kathryn.

Kathryn Tuggle: (33:40)

Thank you.

Jean Chatzky: (33:41)

How can people get in touch with us?

Kathryn Tuggle: (33:43)

Write us an email at mailbag@hermoney.com.

Jean Chatzky: (33:43)

And if you want to send Kathryn an actual letter, she will be happy to receive that too.

Kathryn Tuggle: (33:50)

Absolutely.

Jean Chatzky: (33:51)

Lastly in our Thrive segment today, if your side hustle is draining you or is becoming a chore, there are ways to retain your sanity and your energy while working your side gig. These days an incredible 45%, that’s a huge number, of Americans have side hustles according to Bankrate. And while it’s fine to be all in when you’re first starting out, your enthusiasm in those first few months probably should not become your permanent pace. So, put pen to paper and decide exactly how much time you’re going to dedicate to your side gig. Prioritize what you want to tackle first. Also, keep an eye out for a mentor or support group. Having a side hustle is not like working two jobs. It is working two jobs. And the time and the effort it takes to succeed. Doing this is just not something that everyone understands, which is where a strong community can really come in handy. Lastly, make sure you’re taking steps to conserve your energy and try to treat that side gig the same way you would with your full time job. Take breaks for dinner, for Netflix, for the gym, and for other things you enjoy. Yes, your side gig is important, but so is stepping away from your work and allowing your mind and body so much needed downtime. Thank you all so much for joining me today on HerMoney. Thanks to Alison Gilbert for the great conversation on love loss and moving on. I loved her insight. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts and leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Track Tribe and our show comes to you through PRX. I hope you’ll join me next week. We’ll be kicking off our new year with Julie Morgenstern, bestselling author on time management, organization and productivity. She’s going to tell us all how to kick our careers and our lives into higher gear in 2020. Thanks so much for listening and we’ll talk soon.