Will 2020 be the year you secure that promotion, land a new job, or finally get your side hustle off the ground? Maybe you just want to be better about knocking things off your to-do list each day, or perhaps you’re ready to become that ultra-productive, ultra-accomplished version of yourself you’ve envisioned in the movie montage of your life?

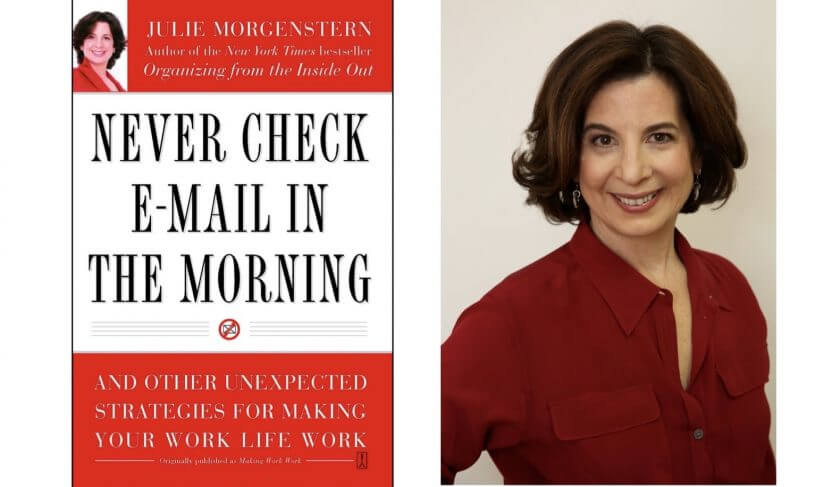

Thankfully on this week’s episode, Julie Morgenstern is here to tell us all exactly how we can get there. Julie is one of the world’s leading experts on organization, productivity and time management, and is the New York Times bestselling author of several books, including ‘Organizing From The Inside Out,’ ‘Time Management From The Inside Out,’ and ‘Never Check Email In The Morning.’ Her books have been turned into a popular executive training program that empowers individuals to ramp up their productivity and get the absolute most out of their hours in the day.

Julie says if you’ve been feeling like you’re treading water, you’re not alone. Many people feel like they accomplish less as they get older, because time seems to go faster. But, she stresses, while there’s great joy in racking up accomplishments, there’s also great joy in a life well-lived; you have to make time for important life connections and experiences along the way.

Julie offers her tips for how to get the absolute most out of the limited hours you have in your work day, and shares her favorite tricks for avoiding getting caught up in a false sense of urgency with all of the day’s email notifications, IMs, text messages, and Slack pings. She also dives into the importance of to-do lists, and the need to have a road map of where you’re going on any given day. She says lists are “a simple tool with incredible power to help you be fully present in what you do,” and cautions that too many of us don’t have a single consistent place where we keep a record of our necessary tasks. Unfortunately, those of us who have our to-dos scattered amongst many systems can spend 30% of our day trying to figure out what we might be missing. She shares her thoughts on the very best place to keep your to-do list to ensure the conversation shifts from “when” you’re going to do something to, “how long is it going to take me?”

If you’re struggling with feeling like you can’t get anything done during the work week, Julie recommends blocking out time on your calendar at work so that you’re always in control of your schedule. Yes, blocking time even for the most mundane of tasks is recommended — that way you’ll be sure to get it done! When it comes to email, IMs and Slack, Julie recommends “batch processing” these messages every 2-3 hours. Many of us feel a false sense of satisfaction simply from checking a screen, when in reality, we’d be much better off (and more productive) if we disconnected from our devices several times a day.

Julie also talks about how we can use some of her most tried and true strategies in our personal lives, and dives into how taking time off can actually make you a better leader and a better colleague. “Really renewing and recharging is one of the best professional investments you can make in yourself. Stepping away gives you perspective and lets your whole brain work on any problems you might be having,” she says. Along those same lines, she talks about the importance of self care, and why sleep, exercise, and the pursuit of our hobbies and passions is so very important to leading a rich and fulfilling life.

Lastly, in mailbag, Jean counsels a woman who was turned down for a credit increase she requested, and offers guidance on credit utilization. She also guides a listener who is considering participating in her company’s employee stock purchase program. We also dive into a debate on buying cars vs. leasing cars. In Thrive, Jean tackles the often tricky, often sticky group birthday dinner, and how we can all improve our group outings (and the impact they have on our wallets) in 2020.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Julie Morganstern: (00:00)

What is your unique contribution at work? Every single person who’s been hired by any company is a serious investment that company is making. So if you define that unique contribution, you then start to plan your days and plan your time to spend the majority of your time doing exactly what you were hired for.

Jean Chatzky: (00:31)

Her money is supported by Fidelity Investments. We want to inspire you to demand more from your money by first knowing what you own, what you owe, and what you want from your money will help you reach your goals faster. At fidelity.com/demandmore. HerMoney comes to you through PRX. Hey everybody, it’s Jean Chatzky. Welcome to HerMoney. Welcome to 2020. Welcome to this brand new decade. We are so happy that you’ve joined us in the new year. I hope you had a fabulous holiday season and I am very excited about this show, which we are calling new year, new productive you. There’s just something about this opportunity to turn the calendar page into January and to do things a little bit better and Julie Morgenstern who has been my friend for God, it feels like a couple of decades now is here to help us all with that. Julie is one of the world’s leading experts on productivity organization time management. She’s a fabulous coach. She is a New York Times bestselling author of several books including Organizing From the Inside Out, Time Management From the Inside Out and my favorite, Never Check Email in the Morning and she is here to help us all ramp up our productivity for the year 2020 and get the absolute most out of our hours in the day. Julie, welcome. Thanks so much for being here.

Julie Morganstern: (02:16)

Oh, thanks for having me Jean. It’s always great to talk to you.

Jean Chatzky: (02:19)

It is nice to talk to you too. So as you look at what people want out of their time, somebody said to me the other day that it feels like the older we get, and I am admittedly getting older all the time, it feels like time just goes more quickly and that we’re able to get less and less accomplished. Am I the only one who feels like that?

Julie Morganstern: (02:44)

No, I think it’s true that as we get older, a couple things seem to make time feel like it’s, there’s less of it or it goes faster. One, I think we actually slow down and I don’t know that that’s a bad thing. I think it’s that we are the moments more. We don’t really want to rush through things as much. We want to be more fully present. And it does take a little longer to do things that way. So that makes time feel more scarce I guess. But it’s not a bad thing. I think the truth is as we get older, we also get wiser. And I think that our values around time shift and when you’re younger it is, especially early in your career, it’s really about accomplishing things, getting things done, moving ahead. And I think as you get older you start to recognize there’s great joy in accomplishment, but there’s also great joy in experience and presence and connection. And when you add that in, life gets richer but you have less time to get the to do list done.

Jean Chatzky: (03:51)

So I guess the aim is to get the to do list done while still making time for these experiences and for connection. I know that your book Never Check Email in the Morning has now become a training program and you’re brought in by these Fortune 500 companies to help their most important employees and executives strategize, prioritize and get the most out of their limited amount of time. What’s behind that?

Julie Morganstern: (04:23)

Well, I think in companies today they are competing more and more for talent. I think people at many stages of their life now really want a sustainable lifestyle. They are not really willing to completely sacrifice their personal lives for their work because then their family life falls apart and their health goes to pot. And younger people really value a whole life existence. So companies are competing for talent and recognize that they need to give their employees both the tools to be productive during work so they have time for a time, you know, a personal life, but also the leaders need to learn how to shape the culture of time in their companies to create environments that bring out people’s peak performance during the work day so that everybody can have time off.

Jean Chatzky: (05:21)

Some of us are fortunate to work for companies that are training us in these sorts of things, but many of us aren’t. How do we start doing these things for ourselves? How can we approach our own daily lives to become more productive and, and to also have a life?

Julie Morganstern: (05:40)

Well, I think there’s a couple of steps. First, you really have to really define the values, define your whole life values, which is I really want to thrive at work and I also really want to thrive in my personal life. I want to have a good relationship. I want to be healthy. I want to have fun outside of work. So define your values first because those values are really gonna inform your behavior anyway, so you might as well define them and then build the systems to support that. And I think then the second thing is to really understand what you were hired for and what is your unique contribution at work. Every single person who’s been hired by any company is a serious investment that company is making. So if you define that unique contribution, you then start to plan your days and plan your time to spend the majority of your time doing exactly what you were hired for and not getting caught up in a false sense of urgency with the email dinging and the IM ringing and you know, hectic last minute meetings that you don’t really need to be in. You’re not even sure why you were called in. It was like everybody come to the meeting and if you know that that’s going to take you away from the highest and best use of your time on behalf of the company, speak up. That’s what they hired you for. So you kind of have to be what I call a time leader, even as an individual, to make sure that the company is getting the most out of you.

Jean Chatzky: (07:16)

When you talk about systems that support productivity, I mean I think you’re talking about things like to do lists and like technology. How important is the to do list? Having a map of where you’re going that day?

Julie Morganstern: (07:32)

I think it’s essential. I think it’s a remarkably basic tool that has incredible power to enable us to prioritize with confidence and be fully present in what we do. So I think with to do lists right now there’s so many different tools and ways that to do’s kind of can be captured that too many of us don’t have a single consistent place where we capture everything. Kind of scattered among some of your to do’s or in your email and some are in your brain and some are on a to do list and if you have your to do’s scattered amongst many systems, I would guarantee you’re losing 30% of your day just in trying to figure out what, you know, where everything is are working on one thing, but knowing wait a minute, I must be missing something else. And not feeling confident that whatever you’re doing is the most important ’cause you don’t even see the whole picture of what’s most important.

Jean Chatzky: (08:31)

Is there a best place to keep them?

Julie Morganstern: (08:34)

Yeah, I mean surprisingly the best place to keep your to do list is not on a to do list. The best place to keep your to do’s is directly in your calendar because your time is all you have to work with to get your to do’s done and a to do that’s not connected to a when rarely gets done. When are you going to do it? It’s not just what do I need to do, but when, Oh, I’ll do that Thursday morning from 10 to 12. Oh I have that errand, I’ll do that on Saturday afternoon while the kids are playing soccer. For every to do don’t just ask what I need to do but ask how long is that going to take and when am I going to do it and directly put it into your calendar and that way nothing gets lost and you can see realistically if you’ve planned your day realistically and doably or you’ve just put in 10 hours of to do’s for a two hour slot, in which case you have to make some adjustments.

Jean Chatzky: (09:35)

One of the things that drives me crazy these days is that my calendar doesn’t quite feel like my own. I am constantly getting meetings, you know, come to this meeting and they just show up on my calendar. I don’t know how they get there and that I think is below my pay grade or above my pay grade or in some other universe of pay grade. But it just, it just happens. And then I feel like my calendar is not my own. Are you suggesting that we just block out times on our calendars so that other people can’t take control of it?

Julie Morganstern: (10:08)

Yes. That if you have, you know the thing that people don’t have time for typically is the big thinking, the proactive work, the innovation, the writing, the analysis. That’s what everybody complains. There’s no time to think or do proactive work in the work day. So we bring that home at night and on the weekends when we’re too tired to be doing that very effectively or efficiently and it throws off our balance. So identify what these big to do’s are and make an appointment in your calendar with that to do and then it’s not available for somebody to just say, Oh Jean’s available at 11 o’clock. No actually you’re not. You had planned to work on, you know, your show strategy for 2020 or whatever or write a blog and, yesm if you pre block, not like a blank block but just, you know, what am I going to do? You put that right into your calendar and it’s the time is not available.

Jean Chatzky: (11:05)

What do you think about email these days? I mean you are, I know, a big fan of not checking in the morning. I wrote a column about it when you first started talking about that ’cause I did think it was so brilliant and yet I’m at this point, guilty of failing. I’m just, I check email when I wake up. If I happen to wake up at three in the morning cause I can’t sleep, I check email then. How do we deal with not just the email pings, but the fact that every time you get a Slack now it comes up or there’s so many notifications.

Julie Morganstern: (11:38)

Yeah. So I think, first of all, we have to recognize that so much of it is when we are overwhelmed and the more we have on our plate, the more likely we are to start being constantly connected to our device. It’s a symptom of overwhelm because when you’re so overwhelmed with what do I do first, I don’t know which of my to do’s to do you feel a false sense of satisfaction by just checking a screen. Let me see what the Slack is or the email. So I think the key is you have to batch process all of your email, instant messaging and Slack time. You have to consciously decide every day, and it might vary every day depending on your meetings and what you have going on, but that I’m going to be on and responsive to email and Slack at this time of the day but not that. For these hours, but not those hours. And if you preplan your screen time and your offscreen time, it’s easier. It’s not easy, but it’s easier than just trying to resist it all day long. It’s like you could set your alarm for 8 and 10 and 12 and 2 and 4 and you set yourself phone alarm for that. And at each of those, every two hours you go and you process your email and you check Slack and you, you know, you’re available for IMs. You can also program your instant messages to be a different sound than everything else. So that can sometimes be a distinguisher if there’s really something urgent. But usually if something’s true, truly urgent, people will call you. I think we have to just learn to batch process. I think that’s the key. It’s not not do it, it’s not hide from it and it’s not be connected all day long. Every step, and there was a study done not too long ago, that tracked people for two weeks and week one they had them just check all their screens continuously all day long, which is the way most of us do it. And then for two weeks they had them do it at designated times and completely turn off all notifications when they weren’t at those designated screen times. And in every single case, people got through as many emails and messages in less time when they batch process than when they did it continuously all day long.

Jean Chatzky: (13:58)

You gave an example of checking t 8 and 10 and 12 is every two hours realistic, do you think? Should it be more, should it be less?

Julie Morganstern: (14:06)

I think it depends on the person and the job and their boss or you know what business they’re in, but I actually think realistically in many cases, even every three hours is fine. And you just have to set expectations with the people you work most closely with and say, I fell into the habit of constantly checking, we’ve all done that, and that’s getting in the way of doing the more proactive strategic work that I’m responsible for and you need me to do. So I’m going to process, I will respond by noon and 5 every day and if something’s more urgent and cannot wait ’till noon or 5 something you need from me in the morning can’t wait ’till noon or in the afternoon can’t wait ’till 5 call me.

Jean Chatzky: (14:55)

Okay.

Julie Morganstern: (14:55)

I think that’s, for many people plenty.

Jean Chatzky: (14:58)

It sounds like a system that I’m going to try. I’m going to give it my best shot and I want to talk a little bit more about outside work, about how to give our personal lives, I guess, the same amount of focus that we’re giving to our work lives in this way, but before I do that, let me just remind everybody, HerMoney is brought to you by Fidelity Investments. You don’t have to know all the answers when it comes to your financial future, but an important question to ask yourself is what do you want from your money? What are your financial goals? No matter where we’re meeting you on your financial journey, fidelity is here to help you reach your goals faster. It all starts with a financial checkup and an understanding of what you own and what you owe. From there, the folks at Fidelity will work with you to evaluate your investment options and ways to grow your savings, discuss your goals, see where you stand and get help taking the next steps at fidelity.com/demandmore. I’m talking with Julie Morgenstern, one of the world’s leading experts on productivity, time management, organization about how we can get the most out of our time and ourselves in 2020 and beyond. You know, when I went out and did the reporting for Women With Money, my most recent book, I asked women what they want from their money and one of the answers that showed up time and time again was time. We want more time, we want it not just for work, but we want it for our personal lives. So how do we use these same strategies to get the most joy and happiness and satisfaction from our personal lives?

Julie Morganstern: (16:36)

Well, I think the first thing is a mindset shift, which is probably the most important thing is to not think of time spent in your personal life as taking something away from your work life. It actually makes you a better worker. It makes you more productive, it makes you more creative, it makes you a better leader. Even if you don’t have a team just as a colleague, it makes you a better client service provider. So recognize that an investment in your time off spent well, really renewing and recharging, is the best thing that you can do for your performance at work. It really is. How often have you looked through the problem at work for months, you couldn’t figure out the answer and it was like when you were taking a drive or taking a shower or, you know, walking through a museum and you were like, Oh my God, I know exactly what we need to do. It gives you perspective, right, to step away and it lets your whole brain do work on the problem, not just a kind of frontal lobe. So that’s one. No guilt. It’s, you’re not stealing from your company by having a personal life. You’re actually serving your company by doing that. And then I think, look, the same principle a to do, not connected to a when never gets done. If you want to exercise or you want to spend time with your family or friends, or on a hobby, you have to actually schedule it into your calendar. And don’t say, if we get through all the chores and I don’t have any work to take home this weekend and, you know, everything else is done on my to do list, then I’ll go to the gym. It’ll never happen. The to do list will never stop.

Jean Chatzky: (18:24)

It never does.

Julie Morganstern: (18:26)

No. So you have to like put that in first and then let everything else kind of move around it. And I think the third thing is, which we haven’t talked about, but I have a new book out called Time to Parent. In which I, I created a roadmap or job description for the parenting years, which are the most time stretched years of a human’s life. And in it, I came up with a framework for self care. And it’s the word self. And this is what I think we need to keep in mind in organizing and planning our time off in a way that recharges us. So self is the acronym, right? We have to fuel ourselves, we have to sleep, we have to spend time on sleep and rest and really prioritize and get, become like sleep ninjas, like really good at sleep. And if you’re not good at sleep, work on getting better at sleep. Change your bedtime. There’s so many ways that you can do that. E is for exercise and fitness, whether it’s formal or informal. L is for love, like all of your love relationships, adult love, relationships with your kids, family, friends. And the F is for fun, which is our hobbies or our passions that make us feel like us. So sleep, exercise, love, fun. And if you think about planning your evenings and weekends around a variety of those four components, you will feel much more whole. If you think in your time off, you only get to choose one, you’ll never feel in balance or whole because every one of them plays a different role in making us feel grounded and fulfilled and satisfied. And like we have a whole life.

Jean Chatzky: (20:16)

Sleep, exercise, love, fun. So I take it you’re a fan of napping?

Julie Morganstern: (20:20)

I am a fan of napping or even just rest. So look, a lot of us are sleep deprived. You know, especially if you’re getting up at three in the morning to check email, it doesn’t help you fall back asleep. The screens actually are creating a lot of the sleep deprivation that we have and sleep problems cause it’s the lightest, so stimulating. So, but so rest is very important and if you just sit still for 10 minutes or you just sit literally just be still and quiet your mind, listen to a little meditation app or pay attention to your lunch and that you know how the food tastes and the temperature of the tea that you’re drinking, you can rest, you can, in 20 minutes or less, and self care and 20 minute doses or less is really the secret to fitting it in every day, more than once a day. If you do these things, rest in 20 minutes or less, exercise in 20 minutes or less, even short burst of connections with others in 20 minutes or less that are really authentic and present are very satisfying. And find a 20 minute version of your hobby.

Jean Chatzky: (21:32)

Well, I love all of this. I think you’ve given us so much to just try to incorporate into our lives as we head forward and one of the things that I learned from you over the years is that it may not work perfectly the first time, but it is kind of like meditation. It is a practice and you do get better at it.

Julie Morganstern: (21:54)

I’m glad you said that because I think the other thing is is you also have to kind of get back on track every time you’re thrown off. So if you’re good on separating yourself from your screen for a while, but then you find yourself checking it again first thing in the morning and last thing before you go to bed and all day in between. Then you just have to break the habit again. It’s like sugar. I think screens are going to be the corn syrup of our generation. Break the habit and habit and break a habit again and never give up on yourself. Just keep the practice going.

Jean Chatzky: (22:28)

Julie Morgenstern thank you so much for a great conversation. Where can my listeners go to find more about you?

Julie Morganstern: (22:35)

I think to come to my website, juliemorgenstern.com and you can read about the books and you can learn about the workshops and also see you can follow me on Instagram and Twitter and Facebook and LinkedIn and all of those handles are on my website so they’re easy to find.

Jean Chatzky: (22:50)

And Julie has a great newsletter. You can sign up for that as well. Thank you so much. I hope to talk to you again soon.

Julie Morganstern: (22:58)

Thank you so much Jean. Happy new year everybody

Jean Chatzky: (23:01)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (23:14)

HerMoney’s Kathryn Tuggle has joined me in the studio. Happy new year.

Kathryn Tuggle: (23:18)

Happy new year. Happy 2020.

Jean Chatzky: (23:20)

Nice to see you.

Kathryn Tuggle: (23:21)

You, too.

Jean Chatzky: (23:22)

Did you have a fun celebration?

Kathryn Tuggle: (23:23)

It was amazing. Was down in Alabama with my family.

JulieMorganster: (23:26)

Very nice.

Kathryn Tuggle: (23:27)

Yeah.

Jean Chatzky: (23:28)

Yeah. We were here in New York but with family, with friends, very low key, which I like on New Year’s.

Kathryn Tuggle: (23:34)

That’s the way to do it.

Jean Chatzky: (23:36)

I’m not a big go out on Valentine’s Day, go out on New Year’s. I’d much rather be either at my home or somebody else’s home.

Kathryn Tuggle: (23:44)

Same. I’m all about being low key on the days when everybody else is out celebrating.

Jean Chatzky: (23:49)

Yeah.

Kathryn Tuggle: (23:50)

Even like Mother’s Day, my mom used to say that Mother’s Day was for people who didn’t love their mothers the other 364 days of the year.

Jean Chatzky: (23:58)

I think I like your mother. Did you make any resolutions?

Kathryn Tuggle: (24:03)

Yeah, I’ve decided to be a better friend.

Jean Chatzky: (24:07)

I’ve, I think you’re already a pretty good friend. I mean I’ve met a number of your friends in the last couple of years and you are beloved.

Kathryn Tuggle: (24:15)

Well, thank you. I think I am a good friend, but I also think I want to give more of my time and more of my emotional energy to my friends because I think in this day and age when you’re on Facebook and you’re on text, it’s too easy to keep things at a surface level and I think I’m going to start diving in a little deeper with my friends.

Jean Chatzky: (24:37)

I love that. For me, I am going to try to travel less this year and I know that’s a very selfish resolution except that I think it’ll have the same impact of making more time for the people who mean the most to me. Planes are hard.

Kathryn Tuggle: (24:56)

I fully salute this because sometimes I look at your calendar. At HerMoney we all have communal access to Jean’s calendar, and let me just say, it makes me tired to look at your calendar.

Jean Chatzky: (25:08)

It’s bad when you are going so many places that you’re pretending you’re not going. I mean, that’s how I do it. That’s, I just pretend that I’m not there. I don’t change my watch. I just, you know, stay on my own schedule and that’s not, that’s really not a way to enjoy the different wonderful cities that I find myself in either. So when I travel, I’m going to travel and when I’m not traveling, I’m going to try to not travel.

Kathryn Tuggle: (25:31)

That’s a great philosophy.

Jean Chatzky: (25:32)

So there we, there we go. As far as Julie’s tips, I think they’ll be helpful. I mean I actually have regressed as far as my email behavior goes, but I’m going to try that every couple of hour checking rather than checking all the time.

Kathryn Tuggle: (25:48)

Right. I was also thinking about how easy it is now with so many of us working in environments where we have flexible schedules and we can just hop on email or hop on our computer when we get home at night, how easy it is that our work is just 24/7. And in many ways it’s good, right? Because you’ll get scripts from may, sometimes at midnight, but I will have also taken into our lunch in the middle of the day with a friend and it seems like a worthy trade off most days, but I also think there are some days when I really need to try to work in 9-to-5.

Jean Chatzky: (26:23)

Yeah, I fully support that and I think just not succumbing to the fact that the work is there. I was in the car yesterday with Eliot for a few hours. We were driving down to Philly to check on the progress of our apartment and I had some work to do, in factI knew I had some scripts from you that were waiting for me, but I had taken the day off and I know it pisses him off to no end when we’re on a long car drive and I’m just working. ‘Cause it makes him feel like, you know, it’s just him and Billy Joel channel or him and Yacht Rock or him and who, you know, whatever’s on Sirius.

Kathryn Tuggle: (27:01)

The passenger has one job and that is to entertain the driver.

Jean Chatzky: (27:04)

Well, that seems to be true and to look at Waze to make sure that we’re not veering off into the hinterlands of New Jersey. But yeah, I just kept the computer closed. I kept it in my bag and I tried to make an effort to just not think about work or play games on my phone or anything like that. And I think it’s a little step, but it’s a step in the right direction.

Kathryn Tuggle: (27:24)

It is.

Jean Chatzky: (27:24)

All right. We have mail. Let’s help some people.

Kathryn Tuggle: (27:27)

Our first note comes to us from Ashley. She writes Hi Jean. I’ve been binging on your podcast for three months now and I love you so much for the work you’re doing for women.

Jean Chatzky: (27:35)

Aw, thank you Ashley. Love you, too.

Kathryn Tuggle: (27:37)

I’m married and currently bringing in the only income in my family while my husband attends school full time. I don’t love my job so I’ve been learning more about FIRE and have began maxing out both mine and my husband’s Roth IRA. Thank you for teaching me about spousal contributions. My question today is about credit reports. I’ve been working earnestly on improving my score and I now have an 802 I recently closed two store credit cards with credit limits equaling $7,000 and in an effort to counteract this negatively impacting my credit utilization, I called another one of my cards, the one I use most and ask them to increase my credit limit. I was shocked when I was denied. What the heck? How did this happen to me? My credit score is so high. I use my credit cards regularly and pay off my balances every month. Can you provide any insight?

Jean Chatzky: (28:25)

So I can make some educated guesses? There are a couple of things that you didn’t mention in your letter that may be impacting this. He didn’t mention your income and your income may be too low to support an increase in the eyes of this issuer. If you’ve applied for other cards recently in the last 6-12 months or so, that can be a contributing factor. If this card is too new, you said this is the card that you use most often. Sometimes I find I prioritize the newest card in my wallet because those are the rewards that I’m all hot and bothered about. If this card is too new, that could be a reason that they turned you down. So the good news is twofold. If there actually was a credit reason that your score was a factor in this decision, you’ll get a letter from the card company. They have to send you one explaining why they turned you down. But the other thing that I want to tell you is that your score is just fine. I mean, you start this letter by saying that you’re doing all of this in an attempt to get your score higher. Your score is higher than mine, so please stop stressing about this and go on with your day. There’s absolutely no need to worry about this. If you were to go out and apply for a loan right now, you would get the best possible rate at your score. If your score was 20 or 30 points higher, you would get no better rate than you are going to get right now, so you’re doing just fine.

Kathryn Tuggle: (29:59)

Great. Our next note comes to us from Eager to Invest. She writes Hi Jean. I’m so excited to finally have a question for you. I found your podcast this year and I’m sad that I’ve now listened to all of them. Your new episodes can’t come out quickly enough. My question is regarding the better return on investment for my money. I received a promotion and sizable pay increase this year and currently make $120,000 plus a 15% bonus.

Jean Chatzky: (30:25)

Woohoo.

Kathryn Tuggle: (30:25)

I currently contribute 5% of my base and my bonus to my company 401k and receive a 4% match. I’m now in a position to contribute another 5% of my salary to retirement savings, and while I could put this into my 401k, I’m considering my company’s employee stock purchase program, which allows employees to purchase the company stock at a 15% discount. The only requirement is that I hold the stock for one year before selling it. My company’s stock is doing very well and continues to rise year over year. This does seem to be the better ROI compared to putting money straight into my 401k. But am I missing anything? If you think the company stock is the best option, what do you recommend I do with the money once I’m able to sell it? My husband is self-employed and does not have retirement savings. Would moving it into an IRA in his name be a possible choice? What might that look like from a capital gains tax perspective? Thanks so much and keep up the great work.

Jean Chatzky: (31:20)

So I love this question because this is the first time we’ve gotten this question in doing this podcast. I think over the past three, three and a half years, and I would absolutely take advantage of this. Many companies have employee stock purchase programs that work much like yours sounds like it works. The money comes out in the form of paycheck deductions, which, like a 401(k) is really convenient and then you use the money to buy the stock at a price set on the closing date of the offering period. And often there are 2 6-month offering periods during each year. The really nice thing about many of these programs is that they protect you from the downside. It’s a little bit confusing, but many programs actually reset the offering period to begin on the last day of the previous purchase period. If your stock declined from the first day of the period to the last day of the period. I would check to make sure that your company actually does do this because it’s important, but I’m all for taking the extra money and putting it into this. And then in the future as you get raises, you may want to split it between an additional 401(k) contribution and putting some more money into company stock. You’re right that you want to hold the shares for at least a year so that you are taxed as capital gains, not as ordinary income, because that’s a really big difference. But one thing that I do want to caution you about, even if the stock is going great guns, resist the temptation to hold more than a year. Just take your gains and funnel the money into Roth IRAs would be my best guess for you and your husband. I would caution you just to double check that Roth IRAs here are the right move. Just pick up the phone, call your accountant and make sure that since you will already have paid taxes on this money, putting it into a Roth, where then it can grow for your future tax free, makes the most sense to me. But s, I think this is terrific. A lot of people have made a lot of money on these programs, so by all means have at it.

Kathryn Tuggle: (33:47)

That’s great that her company offers that.

Jean Chatzky: (33:48)

Yeah, it’s terrific.

Kathryn Tuggle: (33:50)

Our last question is from Debbie. She writes, I would like to hear a discussion of renting versus buying a car. My daughter is positive it is always best to lease and I think definitely best to buy. Could you help us settle this debate?

Jean Chatzky: (34:03)

I can. And the answer is it depends. If you’re the kind of person that always has to have a new car that you are always driving a car that’s three years old or less because you absolutely have to have the latest features and bells and whistles. In that case, leasing can make sense and if your business is paying for it, leasing can make sense. Otherwise if what you’re concerned about is the most economical way to buy a car, then buying one and driving it into the ground is going to be the best thing to do. And preferably buy it used and drive it into the ground. I’m a big fan of the certified used car because you can still get a great warranty. You can still get a lot of late issue features, safety features and things like that and somebody else pays for those early years of depreciation. So I’m a buyer. I’m driving right now, it’s a five-year-old Volvo wagon and I will continue to drive this car, I think, until it’s dead ’cause I love driving this car. So Debbie, I’m with you, not with your daughter but, thanks so much for the great question and Kathryn, happy new year again. Thanks for all of these questions.

Kathryn Tuggle: (35:19)

Thank you. Happy new year.

Jean Chatzky: (35:20)

And can we talk for a moment about how much we secretly hate group birthday dinners? Okay. All right. I know we don’t all secretly hate group birthday dinners but some of us do. I mean God forbid you have any food allergies or you don’t want to drink that night or you want to talk to more than two people at any given time and then the bill comes and you can just bring on the drama. It doesn’t have to be that way. You can make the year 2020 the year that you and your friends resolve to improve group outings once and for all. Here’s the recipe. As soon as a restaurant is chosen, whoever’s organizing that dinner should be responsible for doing some research and letting everyone know just about how much the meal will cost. Then the group should establish upfront whether there will be a split check, separate checks for everyone, or a single person footing the bill. If at any point you’re not comfortable with the decisions being made, don’t be afraid to speak up. If the restaurant looks too expensive, suggest another one that’s more in your budget. And if you know you have a strict price limit for the night, just let your friends know ahead of time so there are no uncomfortable situations the night of the event. Thank you so much for joining me today on her money. Thanks to Julie Morgenstern for the great conversation. I am definitely walking out of the studio today with some new philosophies on working harder and being more productive in 2020 if you like what you hear on the show, I hope you’ll subscribe to our show at Apple Podcasts and leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. We record this podcast at CDM Sound Studios. Our music is provided by VIdeo Helper and our show comes to you through PRX. Tune in next week when we’ll be back with Stacy Dilo and Jennifer Getsky authors of Your Turn, which is all about how women can get back into the work force after a career break. Thanks so much for listening and we’ll talk soon.