As we head into autumn, and everyone’s thinking about back-to-school, my thoughts always turn to those nervous high school seniors who are making their college selection, and those trepidatious college freshmen who are navigating their way across campus for the first time.

How long has it been since you applied to college? And when you think about applying, what’s one of the first words that comes to mind? If you’ve been through it recently yourself, or with a child in your life, unfortunately that word might be “stressful.” These days it seems every school wants something different, and it can take so much time and energy to gather the proper documentation, write the essays, and submit an application you can truly be proud of.

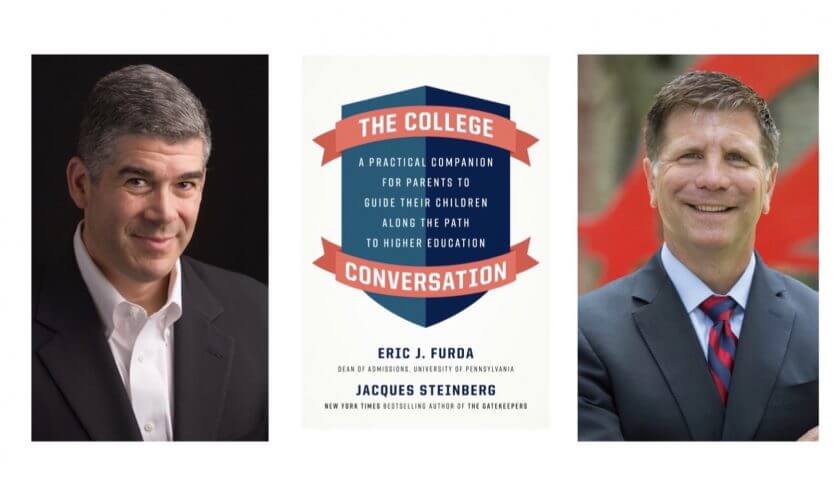

But our guests today say that despite all this, applying to college does not have to be an anxiety-inducing process. Eric J. Furda and Jacques Steinberg are co-authors of the new book, “The College Conversation: A Practical Companion For Parents To Guide Their Children Along The Path To Higher Education.” Rather than tackling the topic of “how to get in,” this book provides parents and students with a step-by-step guide to having some tough conversations, assessing the schools best suited to your interests, getting financial aid, making the final decision on a school, and successfully transitioning from high school to college.

There are few people more qualified to write this book than this week’s guests — Eric is the Dean of Admissions at the University of Pennsylvania, and the former Executive Director of Admissions at Columbia University. Jacques Steinberg is the New York Times bestselling author of “The Gatekeepers” and “You Are An Ironman,” and is a senior executive at “Say Yes Education.” He’s also on the board of the National Association for College Admissions Counseling.

In this episode, the pair weigh in on their previous work in the college admissions realm, and discuss what inspired them to write “The College Conversation.” They talk about the often difficult conversations that families have to have around higher education — including where a child goes to school, how much parents can afford to pay, and the need to take out student loans or consider other education options.

Jacques discusses the book’s “Four ‘C’s” which are essential that families discuss before a college decision is made. They are: Culture, Curriculum, Community and Conclusions. “And very early in the book, we introduce the fifth ‘C,’ which is Cost, and it filters throughout. We want this to be a realistic conversation, and how can you talk about this process without talking about what it will cost, and the opportunities and options for a family to pay for it?” Jacques says.

The pair also break down how you talk about college finances with your partner and your child — It’s so important to just get it all out there and build the comfort zone that will let you have the conversation, Eric says.

In terms of when to start college conversations with a child, you’ve got to know your child, Jack stresses. Having the conversation too early could scare them, but if you have a child who wants to aim for some of the most selective schools in the country, middle school is not too early to broach a discussion.

We also dive into the “uncollege” movement, and discuss the range of opportunities that are out there for students who aren’t considering a four-year college degree as part of their path. Jean shares her daughter-in-law’s story — she went to a coding bootcamp and subsequently tripled the salary she was earning from her four-year degree in art history.

We also talk about how to work with your child’s school’s financial aid office if your family’s financial situation has changed.

In Mailbag, we tackle alternatives to college savings accounts — specifically looking at ways to save money that don’t have to be used for college. We also hear from a listener who’s curious about the best financial books for women just starting out in their careers. Lastly, we dive into where to find a financial planner (preferably a female) who can help our listener with some creative financial plans, and help her send her child to college. In Thrive, we talk about capitalizing on the gold rush, whether you’re looking to buy or sell.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Jacques Steinberg: (00:03)

Very early in the book, we introduced the fifth C, which is cost and it filters throughout. We want this to be a realistic conversation. And how can you talk about this process without talking about what it will cost and the opportunities and the options for a family to pay for it?

Jean Chatzky: (00:26)

HerMoney is supported by Fidelity Investments. Whether you’re celebrating a milestone or adjusting to the unexpected, Fidelity’s there to help you navigate life’s important moments with confidence. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (00:50)

Hey everybody. It’s Jean Chatzky. Thanks so much for joining us today on HerMoney. As we head into the fall and this topsy turvy back to school world, school is a huge topic of conversation. And my thoughts always turn to those nervous high school seniors, who are making their college selections, and those trepidatious college freshmen, who are navigating their way into college for the first time. How long has it been for you since you applied to college? When you think about applying, what comes to mind? If you’ve been through it yourself recently, or with a child, one of the first words that might come to mind is stressful. These days, it seems every school wants something different and it can take so much time and so much energy to gather the proper documentation, write the essays, submit an application that you can be proud of. But my guests today say that despite all this, applying to college does not have to be an anxiety inducing process. I am very, very happy to be joined by Eric Furda and Jacques Steinberg co-authors of the new book, “The College Conversation: A Practical Companion For Parents To Guide Their Children Along The Path To Higher Education.” And what’s interesting about this book, and the reason these guys are here, is that rather than tackling the topic of how to get in, this book provides parents and students with a step by step guide to having some tough conversations, to assessing the schools that are best suited to your interests, getting financial aid, making the final decision on a school and successfully transitioning from high school to college. And there are few people who would be more qualified to take on this topic. Eric Furda is Dean of Admissions at my alma mater, the University of Pennsylvania. He is also the former Executive Director of Admissions at Columbia University. And Jacques Steinberg is the New York Times bestselling author of “The Gatekeepers.” And you are an iron man and a senior executive at Say Yes to Education. Guys, welcome.

Jacques Steinberg: (03:20)

Thank you.

Eric Furda: (03:21)

Thanks for having us Jean.

Jean Chatzky: (03:23)

Sure. Thank you so much for being here. So let me, Eric, start with you. What inspired you to want to write this book and to bring the idea to Jacques?

Eric Furda: (03:36)

Well, again, thank you for having us. In a lot of ways I see the idea for this book as being a step from much of the work that Jacques and I had together when he was at the New York Times with the choice blog. At that point, blogs were really just coming in and it wasn’t a medium that was being used certainly by traditional media. But I think we always shared the value that we wanted to democratize this information as much as possible, whether it was through the blog, through the newspaper, my own blog. And also just thinking about audiences that we have. You have a wide-ranging audience. And so often we would stand in front of a group of a couple of hundred people and to think about a book, hopefully we’re going to reach a far-wider audience. So, I really see this as a progression of the work that we’ve done together over the years.

Jean Chatzky: (04:23)

Jacques, what makes this book different from the other college books out there?

Jacques Steinberg: (04:29)

Yeah. And we certainly acknowledge that there have been exposés that are journalistic. There have been “how to get ins” as you referenced. There was “The Gatekeepers,” which I wrote, which was sort of narrative nonfiction – following an admissions officer around. We wanted to write a book specifically for an audience of parents, but also for mentors and other adults playing a role in the life of a child who is contemplating this daunting search. And we wanted to try to take the stress out of it, as you said. But also provide sort of a form – a way to have conversations about this process, to break it into smaller pieces and to help children and their parents or children and other adults, find a way to have these difficult conversations about college beyond just, hey, can I get in. But where might be the best place for me or places for me to be as a student and why.

Jean Chatzky: (05:27)

When we talk about those difficult conversations, often we’re talking about financial conversations that people just don’t have. When you look at evaluating the right place for you, how much does finance play a role in that? And how do you talk about that with your partner and with your child?

Eric Furda: (05:52)

It’s really a great question, and right in the wheelhouse for your expertise Jean, is I think our approach for both of us in writing this book is any of these conversations, particularly ones that are going to be maybe subjects that have never been broached before, is let’s not delay the conversation. Let’s try to put it out there with some guardrails, as we discuss. You know, not to overwhelm just one conversation, but at least to open it up, so that over a period of time during the college search, that you could revisit that conversation. And so, I think it is really important a. to first get it out there. Say that it’s something that you’re going to try to create some comfort zone to have that conversation. And then have it as part of the larger strategy that you’re putting into place because you use the term value. And so, some of the advice may be well, is value tied to a certain major or type of academic program. Or will I be able to major in whatever I like and kind of pursue some of those other dreams. So, I think there’s a range that needs to be covered, but the first is really making sure that you say that this is something we’re going to have a conversation about and kind of a safe zone.

Jacques Steinberg: (07:00)

In the book, we talk about the various ways you can size up a school in terms of its characteristics. And we talk about the C’s.

Jean Chatzky: (07:11)

The Four C’s.

Jacques Steinberg: (07:11)

The Four C’s. Thank you. And so, they are the culture of that institution, the curriculum, the community, and the conclusions, which are, what are the outcomes, what do students go on to do afterward. Very early in the book, we introduced the fifth C, which is cost and it filters throughout. We want this to be a realistic conversation. And how can you talk about this process without talking about what it will cost and the opportunities and the options for a family to pay for it?

Jean Chatzky: (07:40)

That’s not the only exercise that you have in the book. There’s another one that revolves around the Five I’s. Eric, you want to walk us through that one too? Cause I found it helpful.

Eric Furda: (07:52)

Certainly. And it was kind of interesting too, in terms of the book itself, how these activities started to grow one after the other. And the Five I’s really center around that evaluation of self. And we want students to be reflective as much as possible because this could feed into their letters of recommendation, it could feed into their essays. So, we think about the student’s identity, their ideas, their interests, their intellect and inspiration. And I think throughout the book, Jacques and I do a nice job of saying, you know, here’s a framework. Make it your own. Maybe there’s another word that would pop into your mind, Jean. Say, well, why don’t you do this? And maybe there’s another opportunity. And we don’t want to be so prescriptive, but we do want to provide the opportunity for there to be a framework so individuals can start that conversation within the family.

Jean Chatzky: (08:49)

I think the framework is so helpful. I mean, I remember touring colleges with my children and we made up our own. I mean, we just had a legal pad in the car and immediately after leaving a campus or a tour, even if they were tired and cranky. They had to go through and put their thoughts down, because they were never going to be as fresh as they were in that moment, and answer some of the same questions. Could you picture yourself here? And I forget what else was on the list, but that they could then eventually, hopefully go back and do some sort of an apples to apples comparison.

Eric Furda: (09:38)

That’s right. And that’s really, and it’s interesting because as you were going through with your legal pad, and we’ve had a lot of fun together saying, take out your legal pad, your Google doc, you know how technology has changed. But you capture the absolute point is that families are not going to have fresh in their minds what that visit was like. And you need to jot down a few ideas, particularly if you revisit to fill out that application, six weeks, two months later, whatever the case may be, you need to refresh your memory. And I think we do a really nice job of having these exercises and activities so people can keep that information fresh and then make those comparisons as you said.

Jean Chatzky: (10:16)

When do you start this process with a child? I mean, when do you start having these conversations? Let’s assume that we’ve moved beyond putting your kids in your college sweatshirt and taking them to a game in hopes that they catch the bug – which mine did not. But when do you start talking in earnest Jacques?

Jacques Steinberg: (10:37)

I mean, you’ve certainly got to know your child. And you know, intuitively, that doing this conversation too early could scare them potentially. But if, you know you have a child who wants to aim for some of the most selective institutions in this country, some of the decisions that are made late in middle school in terms of courses, can make a difference in the courses that you take in high school, which those schools will then be interested in. And so in the interest of keeping options open, depending on your child, middle school is not too early to start having some of these conversations. Eric, is that fair?

Eric Furda: (11:15)

I think we were really intentional about striking that balance, as you said – not scaring families off and having this too early in a child’s life while realizing that there are steps that need to be considered even if it’s only annually during a course selection period. So, I think we were really careful about balancing that while saying, you know, middle school, there’s an opportunity here that we want to address a couple of different topics.

Jacques Steinberg: (11:39)

You know, on the other hand, the idea of doing things, taking courses, being engaged in activities for the sheer joy of it, that’s really important in middle school. And that list can kind of get narrowed in high school, but we try to encourage things to not be means to an end in terms of the activities and involvement that young people have in their communities, say in middle school.

Jean Chatzky: (12:01)

Well, especially when, and I know this is not a “how to get in” conversation, but especially when college is so expensive, no matter where you go. And there is a limited pool of merit aid that you want your child to qualify for, that you want to bring the price down as much as possible through scholarships and grants and things that will not put an untenable debt burden on you as you’re trying to save for retirement, or on your child is they’re trying to build an adult life. And sometimes, I think, we get so involved in trying to build the quote unquote resume that it just makes the whole process more stressful than it has to be.

Eric Furda: (12:44)

Well, I think that one thing that the experiences that we’ve all had globally since March and heading into the fall is that there may be a reevaluation of what really matters, as an individual and as a family. And so, what matters really? And what am I looking for? And I think, if anything, I really just don’t think students are going to waste their time on things they’re not interested in any more, once they’re able to get back to whatever they’re getting back to and having those opportunities. I think that’s one. And then on the other side, and this is really your area of expertise, Jean, is thinking about what are colleges going to charge. You know, going back to that value proposition and what’s the larger shake out that’s going to take place, not only in higher education, more broadly, but the way people really see learning and credentialing and how do you get there? And, you know, again, what do you value and what do you seek in that next step of education, post-secondary school.

Jean Chatzky: (13:44)

Eric, hold that thought because I’m going to throw that question right back at you. I want to know what you think is actually coming down the pike in terms of the cost shake up and what it will look like. And I’ll tell you about my daughter-in -aw, who went to a coding boot camp and changed her life in just a minute. But before I do that, I want to remind everybody that HerMoney is proudly sponsored by Fidelity Investments. Some of life’s important moments are planned for way in advance while others we don’t see coming. As always, Fidelity’s here to help you navigate both the joyous and the unexpected events with confidence. Their resources, guides, and tools can help you through all the important financial decisions you have when you need that help most. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (14:38)

I am talking with Eric Furda and Jacques Steinberg co-authors of the new book, “The College Conversation.” So, about a year and a half ago, my daughter-in -aw, who had graduated with a bachelor’s degree in art history, and was stuck in a job that she really, really did not like, went to a coding boot camp for six months, got multiple job offers, tripled her salary and is blissfully happy. And it made me realize, I mean, she could have gone to this coding boot camp without a bachelor’s degree. I do think we are headed into a different world and this is one of those scenarios where COVID has perhaps fast-forwarded us into the future a little bit. Eric, what do you think is coming.

Eric Furda: (15:33)

Well, I’ll take the higher-ed sector, the four-year traditional and Jacques was really great about making sure that we addressed the UnCollege Movement as well in the book. And I think that’s one piece that’s important about the book. This isn’t about kind of get into the four year, highly-selective school and really that, not only acknowledgement, but the understanding that there is such a range of opportunity for students as they’re leaving high school and depending on where they are and thinking about their own path. I mean, clearly higher education as a sector. It was already under-strained financially. And this has really compounded that strain. My concern is there’s going to be a separation between the more resourced institutions and other institutions, because I don’t think that’s healthy overall, for any number of reasons, including choice, while some places are going to be under extreme strain. And as consumers, even for the highly selective schools, as consumers, families are going to ask, is this worth the investment. Particularly if you feel that you’re in that middle income area, getting squeezed from it on both ends. Not necessarily qualifying for a good amount of aid, but then also needing to meet those costs.

Jean Chatzky: (16:44)

Yeah. And Jacques, what do you think? In terms of that UnCollege Movement, which is clearly coming?

Jacques Steinberg: (16:52)

I think that Eric and I imagined reflections very much like the ones that you’re daughter-in-law had. But imagine having that thought as a junior or senior in high school. And, is there a way to have that conversation with your parents? The book is called “The College Conversation,” but one of the conclusions could be community college or a credential or a certificate in the spirit of the work that you’re describing. And so, it would be heartbreaking for students to go through and get a bachelor’s degree when their passion lay elsewhere. And they were doing it because they felt they had to do it, or because they had seen all those statistics that said that a bachelor’s degree gets you more income over a longer period of time. I mean maybe, but what if that’s not where your heart is? And so I think that, uh, as was said, these conversations are going to accelerate and my hope is that there will be more opportunities for students who don’t want to take necessarily that well-worn four-year degree path, at least not initially.

Jean Chatzky: (17:59)

What about for right now? What about in the midst of COVID? If you’ve got a child who’s not sure, or you’re a family, who’s not sure, what are your feelings about just pressing pause and taking a gap year or getting a job for a year?

Jacques Steinberg: (18:16)

I mean, certainly there are studies that have shown pre-COVID that a gap year can be beneficial, both in terms of that extra year of maturity or that extra year of sort of better understanding yourself and what you’re looking for out of that education. My heart goes out to families trying to navigate all this with the visibility so foggy.. And you almost want to approach it on a parallel path. On the one hand, imagine that the pandemic didn’t exist. You’re talking about potentially making a four-year investment. And the odds are certainly good that this crisis will recede, hopefully early in that four year time horizon. But does this argue for getting in and, and deferring for year? Does suddenly that idea of flying across the country to college, maybe a six to eight hour drive away, sounds more realistic. The questions are the same, pandemic or no pandemic, but some of the answers may change.

Jean Chatzky: (19:19)

Eric, can you put on your Dean of Admissions hat for me for just a second or you’re inside the university hat for me for just a second. There are a lot of parents out there whose savings have dropped precipitously, who’ve lost jobs, who’ve seen their financial situations change in COVID. What’s their move with the financial aid office?

Eric Furda: (19:45)

Certainly. And we saw this Jean, right away. In March, families were asking for their family financial situations to be re-evaluated. And usually there’s a lag time from a potential job loss or job loss to it actually having an impact. And the conversations that I know our student financial services office were having is, it was a more immediate impact. And so, helping those families with their individual circumstances, and that is a high touch process, right? You know, you’re working with a counselor, you’re working with an individual to help understand what can make it work for your family. And we’re fortunate at Penn again, to be one of the more resourced institutions, but it doesn’t mean you have a blank check. I’ll give you one other example, though, that I think is really important. And that is for the class that we just admitted, as well as our continuing students, they usually have a summer earnings expectation. And students were not working this summer. They were not earning that 2,500, 3,000, $3,500 a summer because the jobs weren’t there. You know, unemployment went up. And so, ,there was another time, another piece, where the university said, we can’t have this expectation. So, we’re going to fill that with grant money. We didn’t put loans into the package. We don’t have loans in our financial aid packages as part of our standard package. So, already there’s another circumstance that we needed to respond to very early on. And to your point, that’s going to be ongoing until there is a recovery from not only the pandemic, but from the job losses.

Jean Chatzky: (21:21)

So, basically, if maybe you’ve held onto your job until this point, now you get laid off, you pick up the phone and you talk to the financial aid office.

Eric Furda: (21:31)

Absolutely.

Jacques Steinberg: (21:32)

I think it’s important for families to know that these offices are there to resource. It is a confidential process. To err on the side of telling your story. And also, you mentioned alma mater earlier – in a way, the, the idea of putting your child in that sweatshirt – your alma mater regardless of whether your child is interested or not, that financial aid office can be a tremendous resource in terms of understanding this process, whether at that institution or at other institutions. These folks are experts and they get into this work because they want to help make college accessible and affordable.

Jean Chatzky: (22:08)

All right, as we wrap this up here, I’d love one tip from each of you – your best tip for getting the conversation started. And Jacques, why don’t you give me one for parents and Eric, maybe give me one for students.

Eric Furda: (22:26)

As I really think about the opportunity to have a conversation, the conversation, Jean, has to be two ways, right? And so, for the young people, the students who are reading this book, I understand that maybe your parents are bringing the book to you. Jean, I’d like to know how students will actually feel about us saying, gee, thanks Furda and Steinberg for making me do this. But I think you could find some joy in these activities and exercises if you could be open with your family members, with your parents too. Maybe share a little bit. Maybe be a little vulnerable with them in some ways and really talk about what is important to you and have that openness.

Jean Chatzky: (23:02)

Fantastic. And Jacques, from the perspective of the parents, what’s your one tip for starting the conversation?

Jacques Steinberg: (23:08)

I would say keeping an open mind. You may know about 12 colleges or 20 colleges in your own personal experience, but there’s 2000 four-year colleges and another several thousand community colleges. Your child may be interested in one or many of those or interested in exploring. And so, keep an open mind. And I’ll give a half a tip more, which is to set guardrails and boundaries on this process, particularly on your role as a parent. What are those sort of no-go areas for you, where you’re going to give your child sort of the latitude to dream and explore, and what are those areas where it’s going to be really for you to have a vote, including in the spirit of this conversation, on finances?

Jean Chatzky: (23:50)

Yeah, I think we do our kids a disservice when we just say, dream, you can go anywhere, when, in fact, that’s often not the case. And the more you can manage their expectations and enable them to dream within the boundaries that you set for them, the better off they’re going to be. Thank you guys so much for doing this. I’m very excited to have you both here. I think the conversation was really, really helpful and I hope we can talk again.

Eric Furda: (24:16)

Thank you Jean.

Jacques Steinberg: (24:16)

Thank you, Jean.

Jean Chatzky: (24:17)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (24:25)

And HerMoney’s. Kathryn Tuggle joins me now for your mailbag. Hey Kathryn.

Kathryn Tuggle: (24:29)

Hey Jean.

Jean Chatzky: (24:31)

It is so daunting, that college process. Boy, oh boy, oh boy. I’ve been watching, it seems like not from a very far away distance, because the two kids who live next door to me have started college, one last year and one this year. And these conversations, they absolutely need to happen sooner rather than later. And money absolutely has to be part of it.

Kathryn Tuggle: (25:00)

Yeah, it’s so true. I just feel like the whole process is just so much more complicated than it was when I went to college.

Jean Chatzky: (25:06)

And certainly when I went to college.

Kathryn Tuggle: (25:09)

My freshman year was 2001. That is not that long ago. And I feel like the entire landscape is different, which is why it’s so important for books like this to come out every few years, so we have a complete look at what the new landscape is like.

Jean Chatzky: (25:23)

Yeah. I do think that Eric is right, that we are going to see some sort of a shake-out. I worry, not so much about the colleges, the very, very competitive schools, and not so much about the community colleges. I think community colleges are going to just go gangbusters actually. I worry about the schools in the middle that don’t have the big endowments, but that offer a wonderful education for so many kids in this country. I do too think we’re going to see a very big boom in trade schools.

Kathryn Tuggle: (25:58)

Yeah, I completely agree.

Jean Chatzky: (26:00)

But we’ll have to wait and see. What do we have in today’s mailbag?

Kathryn Tuggle: (26:04)

Our first question is from Kay in Colorado. She writes, hi Jean. I love listening to your program. My question is about alternatives to a college savings account. We have two grandchildren ages, seven and five. Their parents and the other grandparents are putting money into college savings accounts for them. My husband and I also have put a little bit of money into their accounts. We’re concerned that one or both of these grandchildren won’t go to college. My husband and I were both teachers and we saw many of our students who were good students, but college was just not for them. We’re wondering if there’s another way to save money for them that doesn’t have to be used for college. We’re thinking of giving them this money at a different time in their lives. Maybe such as when they buy a house or some big event. Do you have any suggestions? Thank you.

Jean Chatzky: (26:47)

What an appropriate question for this episode. Thank you for picking it out, Kathryn. And thank you so much for writing, Kay. I love this question. Yes, you absolutely have alternatives. A couple are Uniform Gift to Minors accounts – what are called UGMAs or UTMAs when the money is in trust for minors. With a Uniform Gift to Minors account, the kids get access to it when they hit the age of majority, either 18 or 21. And so you have to be pretty confident that they will be able to handle the money. If you put the money in trust, you can decide when they are able to access that money. There are limitations on how much you can give, or gift as they say, to kids, without running into gift taxes. But right now those levels are up in the $11 million range. I think, in the amount of money that you’re allowed to give away during your lifetime as an individual, not as a couple as an individual, before being subject to gift taxes. So, I wouldn’t worry about that all that much. The other thing though, I want to put out there is the concept of a Roth IRA. So, when those grandchildren get to the point that they are earning money, which quite clearly they are not doing at ages seven and five, you can make a Roth IRA contribution for them equal to the amount up to the Roth IRA limits that they have in earned income each year. And that money can grow tax-free forever and can be used, not just for retirement, but for things like buying a first home. So, that’s just something to file away for down the road. But I love how you’re seeing that your grandchildren may have different futures than are currently being imagined for them. And thanks so much for writing.

Kathryn Tuggle: (29:02)

Yeah. Such a great question. Our next question is from Rosalie. She writes, hey Jean. Let me start by thanking you for your work and the advice I received from you at a very distressing point in my life. Back in 2012, at the age of 54, I was badly injured in an accident and I was out of work for eight months. During my convalescence, I needed help deciding how to invest the small settlement I received from the accident and how to set myself up financially for the future. With your guidance, I’m happy to say I’m now in a position to retire with over $1 million in savings. My spouse and I are well insured and have plans to enjoy our retirement within our means, but without fear of running of money. My question today has to do with passing on your good advice to my niece, who is turning 21 and graduating from college. Which of your books would you recommend for a young woman just starting out in her career. She’s had a strong reliance on her parents for money and she’s naive when it comes to managing her finances. As my gift to her, I’d like her to be able to start investing at a young age, so that she can not only be independent, but secure throughout her adult life. Thank you for being my financial guru.

Jean Chatzky: (30:10)

Oh my goodness. I love this question as well, Rosalie. I wonder where we communicated about your accident back in 2012. I was doing a show for Oprah Radio at that point, and I bet you were a caller. But I’m so glad that you are doing so well and that you have recovered physically and financially. This book for your niece, who’s turning 21, I think “Women With Money.” I mean at 21, she doesn’t have much I’m sure in the way of financial resources yet, but she can clearly see her potential. There’s a lot of investing advice in the book and I would love it if you would let me just sign one of the ones that I have in my cabinet and send it to you for her. So Kathryn, will get back in touch, we’ll get her name and the address, and we’ll get that in the mail. And thanks so much for making my day.

Kathryn Tuggle: (31:09)

I was hoping you would suggest that Jean. Just perfect.

Jean Chatzky: (31:13)

Thanks.

Kathryn Tuggle: (31:14)

Our last question today is from Tracy. She writes, hello. I’m really wanting and needing to get my financial world in a great place and would like to find a financial planner, preferably a female, to talk me through some steps. I’ve been a single mom for 15 years and would like to find someone who understands my situation. Ideally, I want to find a creative thinker to help me with some plans. I’ve recently become debt free, which is amazing. And I’m sending a child to college this fall. I also just stopped receiving child support after 16 years, so there are lots of changes. I have access to a planner through my employer, but it’s a young male and while I’m sure he’s great, he’s probably not going to relate to my world. If you have any guidance or recommendations, I would be so grateful. Thank you.

Jean Chatzky: (31:58)

Wonderful question, Tracy. And it’s so great that you are looking for advice, that you know that you need this sort of consultation at this point in your life. Generally, I would suggest that you try to make a short list of recommendations from people who are in similar financial situations to you. But it sounds as if you’re not finding that within your circle. So, let me send you to two different websites that I think should be able to help. The first is the website of the Garrett Planning Network. The Garrett Planning Network is a network of financial planners who are fiduciaries and who are willing to work by the hour. And I think that’s really important when you’re not sure exactly what sort of relationship with a financial advisor you want. The other organization is NAPFA. N like Nancy, A like apple, P like Paul, F like Frank, a like apple. It stands for the National Association of Personal Financial advisors. This is the fee-only financial planning association. And both of these websites have zip code locators that can help you figure out how to find a planner in your area and check off some boxes, so that you can make sure that these planners line up with your needs. Once you get a couple of recommendations, I want you to sit down with these people. I want you to talk to them for at least 30 minutes. If you sit down on zoom, that’s okay as well. If we’re not able to meet person to person yet. And you want to gauge how they work, how they get paid, how they would handle a person in your financial situation. You can ask them for a copy of a plan that they’ve done for somebody else. If you’re interested in seeing that, they’ll blank out all the personal information. You can check references, if that’s something that you want to do. And then you do a gut check. You make sure that you feel that you can have an open, honest conversation with this person. Because as I said before, if you can’t, they can be the best advisor in the world, but they are not the best advisor for you.

Kathryn Tuggle: (34:17)

So true, Jean. So true. Such an important relationship.

Jean Chatzky: (34:21)

It really is. Kathryn. Thank you so much for today.

Kathryn Tuggle: (34:24)

Thank you, Jean. It was great.

Jean Chatzky: (34:26)

And in today’s Thrive, cashing in on the gold rush. After more than a decade in the doldrums, gold is hot again with prices hitting record highs, seemingly daily. With the pandemic still raging, investors are looking for safe havens. And as a result, gold has a new found luster. If you have jewelry lying around that you want to sell, now’s the time. With spot prices for gold at record highs, that nameplate necklace from two decades ago, and that high school class ring you never wore, might be finally worth something. The easiest way to sell your jewelry is through a store that advertises it buys gold. These businesses will pay you cash on the spot, albeit at at a discounted rate. These retailers may not be on your corner, but often they’re just a short drive away. Pawn shops are another option, but you won’t get the full value for your gold going this route. You can also look to invest in gold. Sure, there’s a lot to be said for owning gold bars, but that’s not the only way to go. Gold ETFs give you exposure at a low cost and trade like stocks. Investors can choose from several ETFs or go with a mutual fund that invests in different companies support the gold industry. These funds typically cost more, as summer actively managed. Several gold mining and refining companies are publicly traded, enabling you to purchase shares in a particular business. And if you do decide to invest in gold, remember slow and steady wins the race. The last thing you want to do is invest a large amount of money in gold when it’s at the top. If you want exposure to gold, as part of your diversified portfolio, owning a small position makes the most sense. Thanks so much for joining me today on HerMoney. Thank you to Eric Furda and Jacques Steinberg for sharing their insight on all things college and the admissions process. I wish their book had been around when my kids were headed to school. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts. Leave us a review because we love hearing what you think. We want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us. We’ll talk soon.