On Sunday, March 15, the Federal Reserve announced it would slash interest rates to zero. The benchmark U.S. interest rate now ranges from 0% to 0.25%, down from a range of 1% to 1.25% on March 3. The cut comes as the Federal Reserve seeks to boost the economy in the face of the coronavirus outbreak, which has “harmed communities and disrupted economic activity, ” the Fed said in a statement.

The Fed also announced it would purchase at least $700 billion in government and mortgage-related bonds in an effort to protect the economy from the impact of COVID-19. The rate cut and $700 billion bond purchase (commonly known as “quantitative easing”) were both seen as emergency actions taken by the Fed in an effort to bolster the economy and get financial markets running smoothly again, and were the most drastic measures that have been taken since the 2008 financial crisis.

Bottom line: Zero interest rates make borrowing cheap for Americans and businesses in crisis. In other words, a Fed rate cut is good news for borrowers, and for savers it’s an opportunity to make sure you’re getting the best yield you can. The goal whenever the Fed slashes rates is to give the economy a boost.

But what does this mean for you? And what should you do now?

CHECK OUT YOUR SAVINGS RATES

Still getting less than 0.1% on your savings? Even without this Fed rate cut, it’s time to shop around.

Bankrate is showing that the average yield for a one-year CD is around .75%, but many online banks are offering more than 2% on a $500 deposit. The federal funds rate does have a direct impact on the savings and CD offers you will get, and an interest rate cut of 0.50% can be passed along to you, so if you’re looking at a longer investment horizon, you may want to compare 5-year CDs or look at CD laddering (buying multiple CDs with staggered maturation dates).

COMPARE RATES: Looking to up your yield? Compare savings account offers from our partner Fiona.

What does this mean for mortgage rates and other loans?

Mortgage rates have an indirect tie to the federal funds rate—they’re more closely tied to the 10-year Treasury — but mortgage rates have been steadily falling over the past year. Mortgage rates have been below 5% for almost a decade, and right now are below 4%.

But mortgages aren’t the only loans that offer you a chance to save by locking in lower rates as the Fed cuts rates. Car loans and student loans can be refinanced. Credit card interest rates can be lowered, too, sometimes by asking your lender for a break, others by transferring your balance.

Here are some other things you need to do to put some of your interest-related dollars back into your wallet:

WORK YOUR CREDIT SCORE

Your credit score is a major factor in determining the interest rate you’ll pay on a loan. For the best rates, you should have a really good credit score (760 or above) and a near-perfect payment history. Don’t know your score? No problem. It’s easy to snag for free. Amex, Discover and Capital One are just a few of the companies offering free credit scores as part of their card perks. You can also get your score from sites that want to sell you better deals on credit like Credit Karma and Savvy Money.

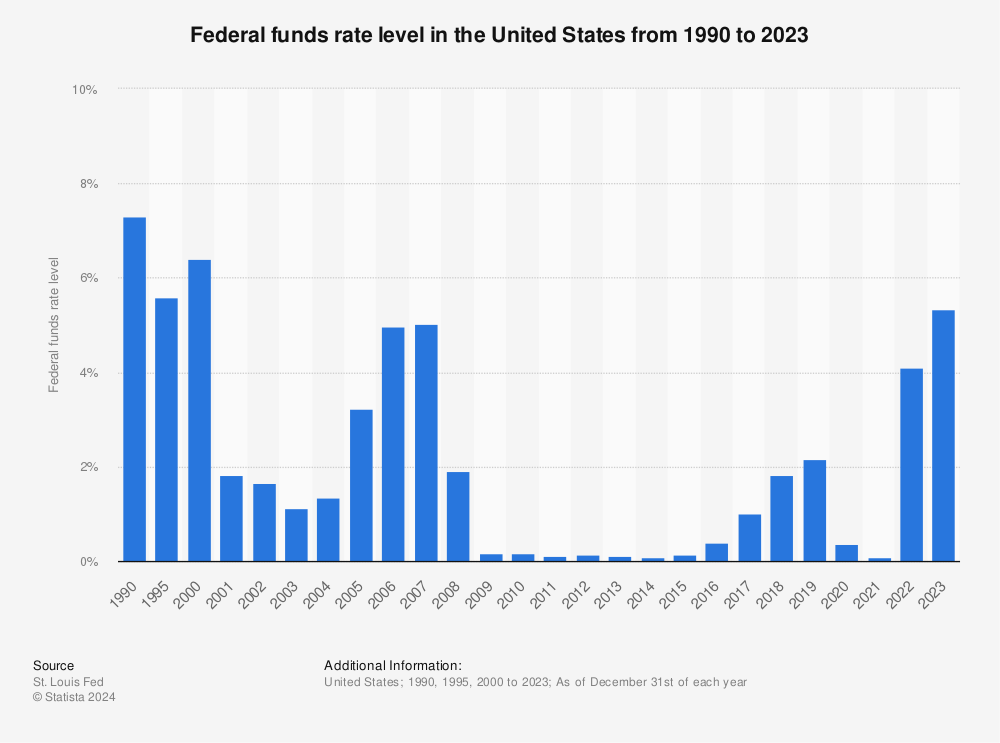

Find more statistics at Statista

You can (and should—looking at you, mom!) also pull a free copy of your credit report from each of the major credit bureaus once every 12 months. Just head to annualcreditreport.com to get your copies. If you find mistakes, they may be one of the things dragging your score down. The first step in getting this remedied is to file a report with the bureau that there’s information on your report that doesn’t belong to you.

What if your score isn’t where you want it to be? Start paying your bills on time every time (automating payments can help); if you have revolving debt on your credit cards, work up a plan to pay it down. Aim to use no more than 10% to 30% of the credit limits available to you. Don’t apply for credit you don’t need. And don’t close old cards you’re not using unless they have hefty annual fees. Your score won’t pop overnight, but it will over 12 to 24 months of good behavior.

REFINANCE MORTGAGES AND CAR LOANS

There may be no financial move easier than refinancing an auto loan. Seriously, it can be done in less than an hour, and auto loan rates are likely lower than they were when you got yours (particularly if you didn’t shop for financing strategically), and they’re going to move lower. ValuePenguin reports that the average interest rate on a 48-month auto loan from a commercial bank has fallen by more than 40% over the last decade. Credit unions often have the best interest rates, but you can use a number of online auto loan search tools to compare loan rates in your area.

Refinancing a home loan is likely something you’ve done already if you’ve been in your home a while. But if you’ve been improving your credit score, it could be time to tap the well again to get a better interest rate, especially with mortgage rates below 4%. Refinancing a home loan is a more involved transaction than a car loan, but the general rule of thumb is that you should plan to be in the home long enough to recoup the closing costs with the money you save by refinancing to a lower rate. To do the math, try running your numbers through Fannie Mae’s refinance calculator. (Here’s more on what you need to know about refinancing your mortgage.)

CONSOLIDATE YOUR STUDENT LOANS

Americans owe more than $1.52 trillion in student loan debt, spread out among about 45 million borrowers, according to Student Loan Hero. And many of us are paying more than we should in interest. Refinancing your federal student loans—and parent loans, like PLUS loans—with a private lender is worth a look to make sure you’re still paying the lowest interest rate possible.

You likely have loans at a variety of interest rates (I know I do), so choose to refinance only the ones that will save you in the long run. And be sure that by refinancing to private loans you’re not giving up something you’d like to keep: Federal loans have protections — plus loan forgiveness for public service workers — that private loans do not.

PS: Get weekly money tips and news. Subscribe to the free HerMoney newsletter!