On the HerMoney Podcast, we love to talk about saving money — about being ready for the inevitable rainy day with a healthy emergency fund, and putting enough aside for retirement that you don’t have to worry about the future… But how much is too much?

Many of us know someone personally who spent a lifetime putting money aside and working to maximize their earnings and savings, only to die with lots of money leftover. It’s a scenario we don’t often talk about, especially since millions of Americans struggle to save anything at all. But there are some of us who are so worried about running out of money that we may squander the opportunity to truly enjoy all that we’ve been working for.

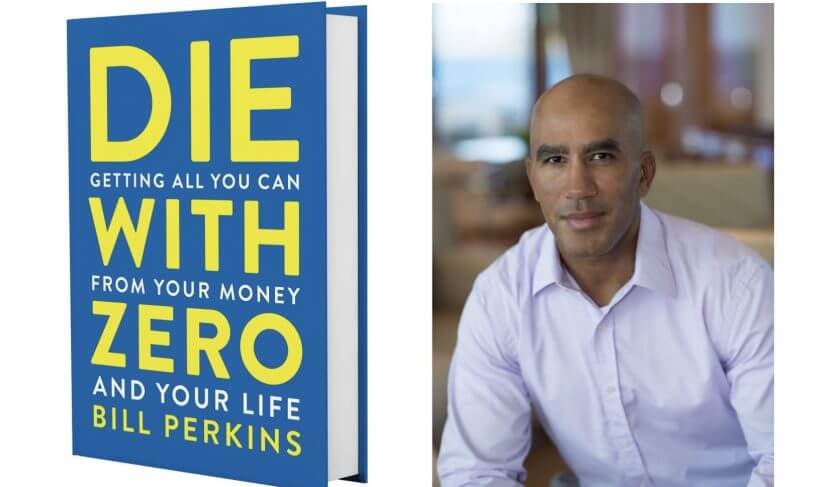

This week’s guest, Bill Perkins, argues that the more time and money we can invest in our experiences during our lifetime, the richer our lives will be. Bill is the author of the book, ‘Die With Zero: Getting All You Can From Your Money And Your Life.’ He’s also the CEO of Brisamax Holdings, and is a Wall Street-trained energy trader and movie investor based in Houston, Texas.

In his book, Bill makes the contrarian case that we should all be spending more of our time and money exploring the world, savoring our relationships, and pursuing our dreams… because it really is true — you can’t take it with you.

Listen in as Bill and Jean discuss what the concept ‘dying with zero’ really means, since it seems like a foreign and frightening concept to many of us. “When something is scary, I like to quantify it. So, one of the things to do is ask: ‘What exactly are you afraid of? What are you worried about?’” Bill says. “I’m all about net fulfillment over net worth — you should fear wasting your life rather than running out of money.”

Bill breaks down his life’s mission — to “rescue people from over-saving and under-living.”

“If your net worth is going up in your 70s, it’s either, you forgot how to party or there never will be a party,” Bill says. “The data shows that it doesn’t happen, and the private wealth clients, their biggest problem is to de-accumulate.”

Many people save religiously over the course of their lives as an “insurance policy” against something going wrong as they age… but in many cases, they’ve saved more than enough to be prepared for anything that may arise. This can lead to them realizing: “Wow, I wasted all this money trying to be an insurance agent with a client of one… and I watched my life pass me by. That cabin where I could have had all those dinners, and family experiences, and the life I wanted to have, I let that go by so I can be an insurance agent for myself.’ And I’m not saying we shouldn’t mitigate that risk, I’m saying let’s go to the professionals to mitigate that risk,” Bill says.

Bill shares some of the many reasons why people save too much and spend too little, and talks about the uncertainty of medical expenses that worry so many of us. He also discusses the importance of “using your life energy in accordance with your deepest values,” and maximizing memorable moments in your life.

Bill says that Vicki Robin’s book, “Your Money Or Your Life” was a game changer for him — catch her episode of The HerMoney Podcast here! Bill says of Vicki’s book: “It’s foundational to my thinking, because it got me thinking about money as the definition of something I exchange hours of my life for, and I went through the exercises, they’re very painful to go through, but to quantify what an hour of your life is worth. Through those exercises, you no longer think, ‘This shirt cost $12,’ you think, ‘This shirt cost me an hour of work,’” Bill explains.

In Mailbag, we tackle a listener question from a woman who is worried that all she does is “work and save,” and is afraid she’s going to regret not taking time to smell the roses in life. (Both Jean and Bill weigh in on this one, and you don’t want to miss their answer at the top of the show!) We also take a question from a woman looking to diversify her investments as she heads into her 40s, and a question from a listener who is curious how filing taxes with her partner may impact his ability to engage in public service loan forgiveness. Lastly, in Thrive, Jean discusses every financial document you’ll need to gather in the event of an evacuation.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Bill Perkins: (00:00)

Wow. I wasted all this money trying to be an insurance agent of a client of one. And therefore I spent hours of my life for nothing. To earn to have numbers on a screen. And I watched my life pass me by. That cabin where it could have had all those dinners and family experiences and the life I wanted to have, I let that go by so I can be an insurance agent for myself.

Jean Chatzky: (00:26)

HerMoney is supported by Fidelity Investments. You work too hard for your money to let it sit on the sidelines. Fidelity can show you how to demand more from your money every day. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (00:42)

Hey everyone. It’s Jean Chatzky. Thanks so much for joining us today on HerMoney. So, if you’re a regular listener to this show, you know how it goes. We do the interview. Then we do the Mailbag. Then we do the Thrive. And today we are shaking it up because I got a letter from a listener, Laura in Sacramento, that was so on point for the discussion that we’re going to be having today, that I wanted our guests to hear it. And so I’m going to read it first. And here’s what Laura said. Hi Jean. I am a huge fan of yours. Thanks for all you do to help women understand and manage our money. I’m going to share lots of details about my situation. I hope it gives you the information you need to help me and your listeners. Here are some facts. First. I’m almost 50, living in California, married with two sons in college, both are debt-free, and we hope to keep it that way. I have $500,000 saved in my 401k mix of pre-tax and Roth. I max out my contributions and the company match every year. My husband has about $200,000 in rollover IRAs. We have a joint brokerage account with about $25,000 and a health savings account of about $20,000. We have $16,000 now in emergency savings and we’ll have $20,000 more in April when I vest in stock grants. We’re also saving $1,500 a month in cash. My husband works as a principal in the public school system. Tell him thank you for that, by the way. And he’s fortunate enough to have a pension. We estimate that when he retires in 10 years, he’ll have 30 years of service with a salary factor of about $135,000, which should yield a monthly pension of about $7,000. I plan to take social security at age 67, which will be around $3000 a month. And my husband’s will be around a thousand a month. Our home is worth $850,000, and we owe $375,000. We have 16 years to pay it off at an interest rate of 3.375. We also owe $18,000 on a car at a super-low rate and have no credit debt. I earn $150,000 a year and my husband earns $138,000. Here is my question. It feels like all we do is work and save and we don’t take time to stop and smell the roses. We would love to be able to buy a small vacation home about an hour away from us, a place to spend weekends and holidays and fish and hike and just relax. It feels like $300,000 would get us what we’re looking for. To buy that place, I’d like to refi our home and pull out $45,000, which would give us money to update our home as well as for a down payment. We’d refi with a 30 year fixed. Although we may not pay off the home when we retire, our retirement income should allow us to make the minimum payment until we’re ready to convert to a long-term rental and then give ours to our sons. Does it make sense to think of our primary residence as a long-term investment or rental property? I love the idea of creating passive income. Also, do you think we’re on track for retirement or do we need to keep saving even more? I know the advice is to be conservative and save, save, save, but I don’t want to miss out on precious family time. Life is short and there is no guarantee that tomorrow will come. Thank you so much for your advice. And Laura, I’m going to be bringing you not just my advice, because I do have thoughts on this, as you might expect. But the advice of Bill Perkins, who is the author of “Die With Zero: Getting All You Can From Your Money And Your Life.” Bill is a really interesting guy. Not only is he the author of this new book, he’s also the CEO of Brisamax Holdings, a Wall Street trained energy trader and a movie investor. He’s also a professional poker player. In his book, he makes the contrarion case that we should all be spending more of our time exploring the world, savoring our relationships and pursuing our dreams. Because it really is true. You can’t take it with you. Hey Bill, thanks so much for joining us.

Bill Perkins: (05:16)

Thank you for having me. What a great question and segue. I want to congratulate her on her awareness. Because part of that letter was saying, hey, I’ve kind of been on autopilot and diligent about my savings. Obviously being frugal and not living above their means by having those types of assets, but understanding what am I delaying gratification for. Right?

Jean Chatzky: (05:41)

Right. What am I delaying life for?

Bill Perkins: (05:44)

Exactly. And my book is about net fulfillment over net worth, right? And her and her husband are building net worth and these retirement plans, et cetera. But she realizes, what I think realizing is that she’s delaying certain experiences past the point of which she can have them, of which he will never get them back. And so, she starting to ask the question, which is the first thing we need to do, is get off autopilot and ask the question. Why are we delaying gratification? What are the experiences we want out of our life? We’re not saving just to make a big number, right? Like, who cares what the number is. We’re saving in order to have an experience, right?

Jean Chatzky: (06:27)

Yeah. Well, I want to come back to that big number for a second. Because I do think there is something in the number and there is, we’ve all been, and I’m probably guilty of both walking this line, but also preaching this message, that you have to save and you have to save because you’re so much more responsible for your financial life than any generation that ever came before us. But I do think in Laura’s case, and in the case of a lot of people, we get so wrapped up in that, that we forget to live. I mean, Laura, buy the house. Please buy the house. And you know, you can save money on the mortgage at this point. You can refi into a 15. You have so many choices. But please go fish and hunt and hike and do the other things. I don’t know if hunt was on your list. But do all of those things that you wanted to do.

Bill Perkins: (07:19)

Yeah. So, we save for survival, right? The saving you’re talking about, taking part of your financial future is, the first thing we all want to do is have shelter, a home food on the table and some money for maintenance of our bodies and the things that we have and enjoy. But after that, it’s for every experience, whether it be a charitable experience, to go hiking, to go biking, dinners we’re friends, have people over. Whatever it is. I can’t list the trillions of experiences that people may or may not want to have. But these experiences, it’s not like the movie, The Bucket List, where like you’re going to die in a month and you get to go tick them off all one by one. Each experience that you have in your life has a season at which is meant to have. The optimal season, right? When you have small kids, okay, the Disney World and the merry-go-round days are well-defined right? That’s an easy example. When you’re in college, there’s certain experiences you’ll do in college and things that are fun to you while you’re in college and not so fun. When you’re a young adult before you have kids. All these seasons come and go. And the experiences that you want to have are not meant to be delayed to another time bucket in your life. And so, if you miss them at that time, you never get them. You miss the fulfillment of those experiences. And that happens all throughout your life.

Jean Chatzky: (08:43)

How do you then balance. I mean, we know there are a lot of people out there who are struggling right now because of COVID, not because of COVID. I mean, even going the pandemic, there were really, really frightening statistics about big chunks of our population who are having trouble saving anything. Plus, the fact that when it does come to this retirement, that, I mean, this family was incredibly lucky. They have pensions. Only 17% of the people in the country have pensions anymore. That is not something that most people can depend on. So, how do you walk the line, both emotionally and financially, with now versus later?

Bill Perkins: (09:26)

Well, this is not a spend, spend, spend book. This is a model, model, model book. This is about taking your life from now, and modeling it from now to the grave. Right? And identifying, getting off autopilot. Like saving is good. And when we get good at things, we make them a habit. And when they become habits, they’re on autopilot. So, you’re just saving for no reason. You’re detached from the experiences of why you were originally saving. You just start saving. It’s like being a hamster in a wheel, taking away the cheese. They still run, right? And we humans will still save. And so, when you model your life and you’re in a situation where it’s like, oh, wait a minute, I’m under saved for survival, right? I don’t have the pension. Then you do the things you need to do in order to boost your savings, increase your revenue, reduce your spending, whatever it is, the experts out there in that vertical will tell you to do, to get you back on model, right? But when you’re in this person’s case, who is clearly an over-saver, right?

Jean Chatzky: (10:27)

Yeah.

Bill Perkins: (10:27)

She is delaying gratification past the grave, meaning that she is going to have resources and capital and money that she will never spend, right? If she keeps on this path. And money not spent are dreams not fulfilled. It’s a life unfulfilled. It is you spending hours of your life, toiling away, going to work, for zero gratification.

Jean Chatzky: (10:54)

I want to push back on that just a little bit, because I do think there is a lot of thinking going on, especially right now, with all of the adult children moving home, about helping our kids. About what we owe the next generation. And although there was a lot in her letter that I sort of skipped over, she’s conscious of that. I’m conscious of that. Of not dying with nothing so that I do leave something to my kids. Where do you put that in your equation? And my charities, by the way.

Bill Perkins: (11:32)

That’s a great question, a great concern. And we all have it. And it’s the number one question I get, or pushback I get is a version of, what about the kids, you know? And another version of that is what about the charities or help? And basically, if we lived forever and did not deteriorate, there would be no reason my book, okay? Everyone, not only do we die, we deteriorate. And so, our ability to convert our resources into experiences, the things we want to do, declines with age. That’s true for our children as well, okay? So, you know, I tell my friends, picking a semi-random date in the future when you’re going to die, to random people, because you don’t know what kids are going to be around, and a random amount, right? Because you don’t know how much is left over because you’re not modeling, you’re not planning. It’s just, oh, whatever, I don’t use, kind of put my finger up in a air, is not a plan. And especially it’s not a plan if your assets are at risk for lawsuit or disaster, et cetera. And that money goes away, then so goes your kids, right? So, just as there’s an optimal time and place for you to be spending your money, right? The balance, it is for your kids. And so, what I tell people is, we’re not giving our kids money at 60, right? We’re 86, they’re 60. That’s not the optimal time to transfer asset to your kids. It’s going to be when they’re mentally mature and physically mature, but not in decline. And I generally say that age is between 28 to 33. You might shift it like, oh no, they’re not mentally mature. We got to push a little bit further. But at a certain point, that is going to be the maximum utility of money for your children.

Jean Chatzky: (13:23)

Yeah. Let’s dig into that a little bit more because that’s a really, really interesting notion. And I can see it in things that I’ve read, and also written lately, gathering steam. This idea that we should be giving our kids, if we’re giving them the money for a start in life, it’s better to do it while they are young adults and responsible enough to handle it than it is to do when they’re 60 and close to retirement themselves cause we’re 85.

Bill Perkins: (13:51)

Well, just think about it. Like when I was up, just say 10 years ago, when I went to Paris, I’d walked 12 miles a day. I’d see the cafes. I’d go all around. I’d do everything. When I go to Paris now, I’m looking for six or seven before it’s not enjoyable anymore. Paris does not have the same value to me. And that’s happened to everybody. When I went to St. Petersburg, they let you climb the steps of the church. 211 steps and you walk around and you could do a lot of things in these Eastern European countries. Not one tour bus had one person over 60 climb those steps, not one person. It was a different St. Petersburg. So, if you’re trying to give them life, right, because that’s what the money is. It’s life energy. It’s hours of your life converted and represented in these pieces of paper or yen or whatever you want to call it. If you’re trying to give them the maximum, right? You want to do it at the right age. You want to do it at the right age. And also, if you don’t quantify it, everybody starts living suboptimally, right? You’re giving it to them at a later in life, when opportunities and experiences that they no longer have the temperament ability or like it anymore, becomes difficulty is up. They can’t do them. You’re actually giving them less a gift as you give it to them later. And on top of that, by not separating it out and knowing that number, you’re kind of, you know, in this fuzzy world of, I gotta leave them something, I don’t know what it is, et cetera. And you can’t model your life, right? So, now you’re now you have multiple lives that are not being modeled. And then thus suboptimal and wasteful.

Jean Chatzky: (15:23)

I want to figure out a little bit about how you became you, because I wouldn’t think that an energy trader would end up with these views on life. And I’m sure that there was some experience or other that just turned on the light bulb for you. But before we do that, let me just remind everybody that HerMoney is proudly sponsored by Fidelity Investments. It’s no secret that women are on a different financial journey than men. So, it’s important to plan for those differences when thinking about retirement, social security, investing and more. Fidelity can help. They’re taking steps to help women demand more from their money, our money. Because we have all worked way too hard to get where we are to keep our money sitting on the sidelines. Get the skills and investment advice that you need to put it to work for you. And you can visit Fidelity.com/HerMoney to learn more. We’re back with Bill Perkins. He is the author of the new book “Die With Zero.” Okay, Bill. What happened in your life that made you wake up?

Bill Perkins: (16:30)

Oh, it’s kind of like those movies where like, small pieces of information or experiences I had, all pointed in the same direction, to the same philosophy. And, you know, some of it was books. There’s a book called “Your Money Or Your Life.”

Jean Chatzky: (16:48)

Yeah. Vicki Robin. We had her on the show.

Bill Perkins: (16:50)

It’s foundational to my thinking because it got me thinking about money as a definition of something I exchanged hours of my life for. And I went through the exercises. They’re very painful to go through, but to quantify what an hour of your life is worth. And then, through those exercises, you don’t think of things like a shirt cost, $12. You think of a shirt cost me, you know, an hour of work. Or whatever it is, 30 minutes of work, et cetera. And so, I started to think about, what do I want to do with this life energy that I have? What experiences and things do I want to exchange hours of my life for? I was working on the exchange floor saving money. I was as frugal as possible on a very, very low salary. And my boss told me, you know, I was proud. I thought I was going to get a gold star for saving a thousand dollars on like $16,000 a year. Plus some extra money I worked driving a limo at night, to make ends meet. And he said, you know, excuse my French. He said, you’re a fucking idiot. What are you doing? You didn’t come here to make $16,000 a year. You came here to make millions. Your salary is going to grow. Take that money and go spend it. And I was like, it hit me. I was like, he’s right. Like, why am I depriving my future richer self. And I was certain, I’d be richer cause I could have just quit and waited tables and made more money, right? And I did sign up for this job to make a lot more money. So, why am I depriving my future richer herself? You know? I’m depriving my poor self in order to give to my richer self, right? I should be having these experiences that are meant for 20 year olds.

Jean Chatzky: (18:26)

It’s interesting.

Bill Perkins: (18:26)

And so, that kind of sunk in. And there were just small experiences along the way of me asking the question, you know, as an arrogant young person, right? I see people 50, in New York City. You can’t swing a dead cat without hitting a rich person in New York City, right? And I think, yeah, but they’re old, who cares. You know what I mean? Like what are they going to do with the money? Like it’s too late for them, right? And that was ages. And I was completely off because that’s my age now. But what I did get right was the direction, right? At some point it’s too late.

Jean Chatzky: (19:06)

Can we talk about how risk plays into this? I mean, I’m talking to you, for everybody who can’t see Bill, as I can see him. He is in a hotel room in Vegas. Cause he’s there for the World Series of Poker.

Bill Perkins: (19:19)

For the World Poker Tour.

Jean Chatzky: (19:19)

World Poker Tour. Because he is there for the World Poker Tour. And you’re a championship poker player. I mean, you play professionally.

Bill Perkins: (19:32)

I would call myself an amateur, a good amateur. How about that?

Jean Chatzky: (19:34)

Okay. You’re a very, very good poker player. I, like many women, have trouble with risk. And although what you’re saying makes complete and total sense to me, it also sounds like taking a lot of risks with my future. And I don’t know how to incrementally, as a woman nudge, myself there. I know myself, and I know our listeners, and I don’t think we can do it a hundred percent by jumping in. But I do think that you make a lot of incredible points. So, how do you nudge people there?

Bill Perkins: (20:20)

There’s just two things. I think, you know, when something’s scary, I like to quantify it, right? And so, one of the things to do is to quantify what exactly are you afraid of? What are you worried about, okay? And part of that is in the exercise I put in. I put in kind of like a time bucketing. Because you just don’t have a bucket list. Like I said, experiences are meant for a certain time. So, let’s break up our lives in three to five year increments to the grave, okay? To our estimated death date. And start writing out and putting down the experiences we want to have. And you’re not going to do it in one day. It’s impossible. Because we’ve been on autopilot. Earning, earning, earning, Saving, saving, saving. We’ve become detached from the reason we’ve earning. But over time, a month, you know, just any frequency that you can sit down and say, okay, 50 to 55, 55 to 60, 65, you know, and so on, right? And start putting the type of activities you want to do. You’ll start to understand what your spend pattern is. What you really are going to spend on. And then, also, I try and tell people, you need to fear wasting your life more than you fear going broke. You know, we need it. Or at least we need to dose that in, you know? I’m all about net fulfillment over net worth. I don’t care if you’re busted. I see people who are busted who are having the most adventurous, fulfilling life ever, relative to, to me, okay? And I’m like, oh wow, I’m doing it wrong. I need to get off autopilot. But that may look different for every other person. But we need to think about our lifetime fulfillment. Fear wasting your life, you know? Shift that over. And then the other thing is, is once we’ve identified those fears, let’s work to mitigate them, right? And I think what over-savers do, and those who save, tend to over-save, is try to mitigate every single risk in the book by being their own insurance agent. Like if I just had enough money, I can insure myself from this bad thing and that bad thing. And what happens by being your own insurance agent, you’re woefully inefficient, and you still won’t have the capital base. And so, it’s like, wow, I wasted all this money trying to be an insurance agent of a client of one. And therefore I spent hours of my life for nothing. To earn to have numbers on a screen. And I watched my life pass me by. That cabin where it could have had all those dinners and family experiences and the life I wanted to have, I let that go by so I can be an insurance agent for myself. And I’m not saying we shouldn’t mitigate risk. I’m saying, let’s go to the professionals to mitigate that risk, you know?

Jean Chatzky: (23:11)

Okay. So, let’s bring it back to Laura as we wrap this up. I think she should buy that second house. How about you?

Bill Perkins: (23:19)

Oh, definitely. I think the refi, she quoted some technical things, right? Which is not my book. My book is an optimization of your whole life. But there are some refi things she should be doing in there to take that money back out. Why be paying it to a bank and interest rates are at, I mean, all-time, historic lows. I think she should be thinking about on the return on experience. Memory dividends. You don’t retire on your money. You retire on your memories, okay? When you’re older and you’re 70, you don’t want to go anywhere. And people are like let’s go. And you’re like, I don’t have the disposition, the energy, et cetera. I just want you to bring over the grandkids and talk about all the old times. That’s what you retire on. So if you want to have a healthy, full retirement, you need to get the hell out there and create the experiences that you want to have. And so, I am a hundred percent in favor with these pensions that they have, which is a form of an annuity, that is an insurance product. They are well situated to take these steps, to make these moves.

Jean Chatzky: (24:18)

I think you’re absolutely right. Although I think the age at which that happens, where you start banking on your memories and not wanting to go places, and I say this because my mother just turned 80. I think it’s much closer to 80 than it is to 70. 70 people are going great guns.

Bill Perkins: (24:38)

I mean, you know, I’d love to believe that. But in my family, that’s not true. And I think it’s really based on your biological age, not your actual age, right? So, that’s there. But when I look at the census data, and I look at net worth per household, it just keeps going up. And what that tells me, if your net worth is going up in your seventies, it’s either you forgot how to party, or there never will be a party, right? I tell people, well, it keeps going. I’m like, when’s the party. Just tell me what date, you know? And the data shows it doesn’t happen.

Jean Chatzky: (25:12)

Yeah.

Bill Perkins: (25:13)

And the private wealth clients, their biggest problem is getting their clients to accumulate.

Jean Chatzky: (25:18)

Yeah. No, you’re totally right. This has been such an interesting conversation. The book is “Die With Zero.” Bill, is there a website where we can find more about you?

Bill Perkins: (25:27)

You could go to DieWithZeroBook.com to find out about me. You can find me in the Twitter streets @BP22 is on Twitter. I’ll answer any question. I’m an addict to Twitter, just like many people. I love the battle in Twitter. But, you know, on the book, there’s some tools on what I talked about – time bucketing. Like identifying the experiences and put them in. There’s some tools to help you there. We’re going to create new versions of that so that people can have an exercise to actually model their life. And there’s also a spend model. So like what you should be spending based on how much you need for retirement, your survival number and a track to spend down optimally. It’s just a guideline to make sure you don’t die with a million dollars and wasted opportunity. Die with zero regrets.

Jean Chatzky: (26:14)

Love it. I love it. Thank you so much for being with us.

Bill Perkins: (26:18)

Thank you. Thanks for having me.

Jean Chatzky: (26:19)

Absolutely. And we’ll be right back with Kathryn and the rest of your mailbag.

Jean Chatzky: (26:29)

Kathryn is back with the rest of your mailbag. Thank you for allowing me to hijack the first question for the top of the show. I just thought that it really belonged there.

Kathryn Tuggle: (26:38)

Oh my gosh. Yes, no, totally. I mean, that’s why I put it in the script. I felt like it really spoke to exactly what Bill is talking about. Obviously, we know that there are millions of American families who simply can’t save enough and who have lost jobs, who are struggling right now. But there is a percentage of people out there, and I would honestly put my parents into this category, of people who have worked and saved their whole lives, who could enjoy their money more. And you’ve worked too hard for your money to not reap the benefits.

Jean Chatzky: (27:12)

I totally agree.

Kathryn Tuggle: (27:14)

And let go of some of that stress that you feel of not having enough. At a certain point, you have to say, you know what, I’ve done a great job and we’re going to have some fun.

Jean Chatzky: (27:23)

Yeah, absolutely. And that may mean, as we talked about, defining what is enough. You know, defining the concept of enough and allowing yourself to be okay with that. There also, I think right now, with so many adult kids moving back home with their parents, is this big question of what we owe the next generation. And, you know, if we feel, like many of us do, that they are going to end up paying the price for a lot of what we’re going through now, how do we make sure that we provide the younger people that we love with as much as we can without hurting ourselves.

Kathryn Tuggle: (28:08)

That’s such a great point. I think that COVID has put multiple generations under the same roof, and that has opened up a lot of dialogue around what are we doing to help one another now? What will we be doing when we pass? How are our finances set up? You know, I like to think that maybe some conversations that might not have happened otherwise are happening now because of more family time spent together.

Jean Chatzky: (28:38)

I hope so too. Yeah. So what do we have?

Kathryn Tuggle: (28:41)

Well, our next question is from an anonymous listener. She writes, hi Jean and Kathryn and the HerMoney team. I would like to first thank you for your podcast. I’ve been listening, retrospectively, for the past few months, and I can’t thank you enough for the confidence you’ve instilled in many of my financial decisions and planning. I’m 37 years old and I’m a saver with a capital S. Up until recently, I’ve been absolutely terrified of the market and learning all that I know now, I’m kicking myself for not starting sooner. But better late than never. Here’s my landscape. I have a Roth 401k with a 5% employer match and a traditional IRA that I can max out and have since 2019. I have $72,000 in an emergency savings account, which is probably more than I need. But I live in LA and I have expensive rent. I have $50,000 in an investment account with an advisor and he’s trickling that into the market now. I have another $128,000 in a CD, which I plan to invest more of with a little more confidence. I also tried to open an HSA, but my was too low to qualify. And it’s something that I’ll re-examine during re-enrollment in November. So, here’s my question. How else can I diversify? The housing market in LA is outrageous and it terrifies me to sink all of my savings into a down payment and, what’s more, be nervous for the mortgage payment which I can hardly afford. One bedroom condos start at $1 million in a neighborhood that’s safe enough for a single woman. So, that’s on pause until my life circumstances change. Is an investment property in another state a possible solution or maybe more of a headache? Also, my advisor has suggested a whole life insurance plan, which I have read can be used as another source of retirement funding. I’d be guaranteed 4% interest, but the premium is high at a thousand dollars a month and it seems like more of a burden for the long haul than a safe option for a risk averse person like myself. Am I missing something? Thank you so much for all that you do. Your work has the potential to impact female and male generations to come. I am already talking to my five-year-old niece about the importance of financial education. Words that were never uttered to me.

Jean Chatzky: (30:45)

Oh. Well, thank you so much for writing. And let me just say, you’re doing great. I’m so glad that you found your way to this podcast. I hope that it has inspired you to read more and learn more. And focusing in on that $128,000 in the CD, I’d like to see you roll that out of the CD and into more of a long-term investment, unless you decide that you’re going to use some or part of it as a down payment on some sort of a property, which would be fine. It seems like buying properties, sort of reading between the lines of your letter, is what you want to do right now. And I get not wanting to buy in LA. I get not wanting to plunk that money into a condo that you think is outrageously priced. And so, I wonder if you look at investment property in another state, if you look at investment property in a less expensive part of California, is that something that you could see using? Is it something, if you bought a second home before you bought a first home, is it some place that you think that you would spend time? Is it something that you think you would enjoy? Or, if you buy it as an investment, how does the thought of being a landlord sit in with you? We have a show, and you’ll want to look at that, with Julie Lamb and Annie Dickerson. They invest in real estate through a syndicate. So, it’s a group way to invest in real estate. So, although there are fees, you don’t have to deal with the issues of the toilet breaking in the middle of the night. So, listen to that if you haven’t already. I’m not so big on the whole life insurance plan for you. You’re a single woman. You don’t need life insurance. And so, you are just better off trying to maximize your ability to put money in tax-deferred investments like your IRAs. And then, if not, invest in a diversified portfolio outside of your tax-advantaged accounts. You can do this with more and more money, and it will still provide the diversification that you need. When you’re putting money into funds that have thousands and thousands of stocks, you don’t really have to look outside for additional diversification. You have to make sure that you’ve got enough money for the short term, the medium term and the long term, depending on your goals. But searching for different investments, investments that are non-market investments, unless that’s something that you are really looking to do, is not something that is a must, at least not on my list. So, congrats on all of this and let us know what happens.

Kathryn Tuggle: (33:42)

Yeah, please do. We would love to know how it shakes out. I definitely feel for her in an expensive city living in New York. It’s so disheartening.

Jean Chatzky: (33:52)

Yeah. Although I’m looking at New York right now and it is disheartening. But I wonder, and I don’t know the LA real estate market. I wonder if COVID has done to some sections of LA, what it has done to real estate in New York, which is open up values.

Kathryn Tuggle: (34:06)

Yeah, that’s a good point. I mean, definitely so many of my friends have left the city for the suburbs. There’s some really good deals to be had right now.

Jean Chatzky: (34:14)

If it’s been a little while since you’ve looked, you may want to look again.

Kathryn Tuggle: (34:18)

Thanks so much, Jean. Our last question is from Margo. She writes, hi Jean and Kathryn. I have a bit of a complicated question, but I figured I would ask because there may be other women in my position with the same question. I’m married and my partner and I both file as married, filing separate, because he’s making payments for public service loan forgiveness and, this way, his sole income is taken into account for the monthly payment amount. One accountant I spoke with said that this wasn’t allowed because my partner and I live together, and another accountant I spoke to actually advised doing this strategy in the first place and said it’s fine. I’m confused and don’t want to make a mistake on my tax filings for this year. Please advise. Thank you so much.

Jean Chatzky: (34:59)

So, I was with the second accountant. I thought, this is fine. I’ve heard of people doing this in the past. And the real question that you need to ask yourself is whether you’re saving more money on the forgiveness of the loan long term than you would be saving, married, filing jointly, because we all know there is a penalty for married, filing separately, when you look at the additional taxes that you pay. But because I wasn’t 120% certain, and we had two accountants here, I actually quickly shot your question off to Mark Kantrowitz. And Mark is with the website, SavingForCollege.com. He is and has been my go-to on any question related to financial aid for so many years, I can’t tell you. And he confirms, and here’s what he wrote. The monthly payment under certain income driven repayment plans is based on just the borrower’s income if a married borrower files a separate return. This is true for ICR, that’s income contingent repayment, IBR, income based repayment, and PAYE, which is pay as you earn, but not REPAYE, which is the revised pay as you earn. And he points out that he’s got a comparison chart up on Saving For College. The accountant who claims that she can’t file as married, filing separately because she and her partner live together is wrong. A couple cannot file a joint return unless parties agree to a joint return. There is absolutely no prohibition on filing separate returns if the couple lives together. Filing a separate return causes the loss of certain tax benefits, one of which applies if the couple lived together during the year. So, you want to take a look at that because that is going to add into the point that I made about paying more taxes. But he suggests perhaps this accountant is just getting confused by the rules for determining whether a couple is married or not, which is bizarre, but maybe that’s where it is. In any case, this is fine. Go to SavingForCollege.com. Look at Mark’s chart. And then if you, by any chance, file your taxes with a program like TurboTax, input your information. Then click married, filing jointly. And then click married, filing separately and see what the difference is in the amount of taxes that you pay. And you’ll very quickly know if you win or lose by doing all that is necessary, and we know there is a lot necessary, to qualify for public service loan forgiveness. And thank you to Mark Kantrowitz for being on email when I needed him.

Kathryn Tuggle: (37:58)

He’s the best.

Jean Chatzky: (38:00)

He is. He is but, you know, this is accounting. And as we have said many, many times before, I am certainly not an accountant.

Kathryn Tuggle: (38:09)

Wow. Great advice. Thank you so much.

Jean Chatzky: (38:11)

Sure. In today’s Thrive, every document you need to gather before you evacuate. When the worst is happening around you, you may not have the time or the wherewithal to run down an itemized list of the important things that you’ll need to get you through. At Hermoney.com, we have a complete list of the documents that you need to pack for an emergency getaway. And note that for items on the list, copies are fine, as long as the originals are in a secure location, like a safety deposit box at a bank. Just never leave the originals at home, especially when you know you’re in a hurricane or a fire zone. Here’s what you need. Certified copy of your birth certificate, your driver’s license, social security card, passport or ID card, health insurance ID cards, policies and medical records, auto insurance ID cards and policy details, homeowners insurance policy declaration payments, home deeds, car titles, legal paperwork, like wills, support orders, powers of attorney and healthcare directives, marriage or divorce certificates, bank and financial statements, and video, if you have one, or pictures, showing the contents of your house. Yep. All these items can be replaced, but that can take time and effort that you may just not have after a disaster. The two most important items on the list, your birth certificate and your social security card, since you may need those to help you replace some of the other documents on the list. Last, keep in mind, digital backups of many of these items are just fine. So, those pictures showing the contents of your house or the video, if you have it, it can be stored in Google drive and you can access that from any location.

Jean Chatzky: (40:04)

Thanks so much for joining me today on HerMoney. Thank you to Bill Perkins for such an interesting conversation and inspiring us to look at what’s enough and what we truly value to make our financial lives work just a little bit better. If you like what you hear,PI hope you’ll subscribe to our show at Apple podcasts. Leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you from Megaphone. Thanks so much for joining us and we’ll talk soon.