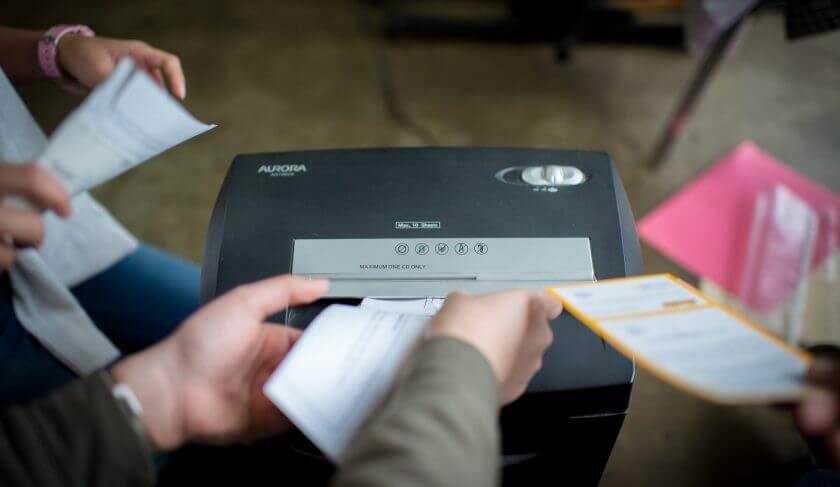

If you haven’t already opted to go paperless, you might be swimming in a flood of receipts, bills, pay stubs, tax forms and other financial documents. But how long should you keep medical bills? You may want to go paperless and throw some of those financial documents away.

Some of those papers you have collected need to be kept, but many others can be shredded and tossed. Here’s how long to keep medical bills and which financial documents to ditch.

FIXX YOUR FINANCES: Need to get your money right? Join FinanceFixx — Jean’s money makeover program gets you a coach and fast, sustainable results.

Receipts

How long to keep: Three years.

Receipts for anything you might itemize on your tax return should be kept for three years with your tax records. Try storing them in a file folder broken out based on spending categories.

Home Improvement Records

How long to keep: A minimum of three years, but as long as seven years.

Hold these for at least three years after the due date of the tax return that includes the income or loss on the home when it’s sold. If you plan to sell the house, and you have made improvements to it, keep receipts for those improvements for seven years — you may need them to lower the taxable gain on the house when you sell it.

Medical Bills

How long to keep: One to three years.

Keep receipts for medical expenses for one year, as your insurance company may request proof of a doctor visit or other verification of medical claims. As of Jan. 1, 2019, you may only deduct the amount of the total unreimbursed allowable medical care expenses for the year that exceed 10% of your adjusted gross income. If you take that deduction, you’ll need to keep the medical records for three years for tax records.

Paycheck Stubs

How long to keep: Up to 12 months.

Keep paycheck stubs until the end of the year, and discard them after comparing to your W-2 and annual Social Security statements.

READ: Control Your Financial Clutter in 4 Simple Steps

Utility Bills

How long to keep: One year.

Keep for one year and then discard — unless you’re claiming a home office tax deduction, in which case you must keep them for three years.

Credit Card Statements

How long to keep: Up to three years.

Keep until you’ve confirmed the charges and have proof of payment. If you need them for tax deductions, keep for three years.

Investment and Real Estate Records

How long to keep: Three years.

Keep for three years, as you may need the documentation for the capital gains tax if you’re audited by the IRS. These records help track your cost basis and the taxes you owe when you sell stocks or properties. Once you receive the annual summaries, you can shred your monthly statements.

Bank Statements

How long to keep: Three years.

You’ll need bank statements for up to three years if you are audited by the IRS. If your bank provides online statements, you can switch to receiving your bank documents online and cut down on paper.

LISTEN: Download the HerMoney podcast and listen wherever you stream your favorite podcasts.

Tax Returns

How long to keep: Three years.

The IRS recommends that you “keep tax records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later.” If you file a claim for a loss from worthless securities or bad debt deduction, keep your tax records for seven years.

Records of Loans that Have Been Paid Off

How long to keep: Seven years.

You’ve paid it off, and you don’t want to have to pay it again. Just in case a bank or processing error shows up down the line that you might not be in the clear, make sure to hang onto any records of loans — this includes student loans, car loans, etc. — for seven years.

Active Contracts, Insurance Documents, Property Records or Stock Certificates

How long to keep: Until they are no longer active.

Keep all these items while they’re active. After contracts are completed or insurance policies expire, you can discard these documents.

Marriage Licenses, Birth Certificates, Wills, Adoption Papers, Social Security Cards, Death Certificates or Records of Paid Mortgages

How long to keep: Forever.

There are few things that are more important in the world than documentation of your life. It starts at registering for school with birth certificates, and will stay with you for your entire life. Each of these documents is necessary in the financial world as a way to confirm your identity and to make sure money, property and other valuable items that are yours, will continue to be yours until you say otherwise. Keep these documents forever, and store them in a safe place.