Unfortunately, identity fraud is everywhere. In 2017, more than 6% of consumers fell victim to it, and 33% of adults in the U.S. have experienced identity theft of some sort. Every day, credit card numbers are swiped, and fraudsters are constantly thinking of increasingly clever ways to text, email, call, or otherwise hack their way into our lives. What does this mean for all of us? It means we have to take additional steps to ensure our own security, particularly where technology is concerned…

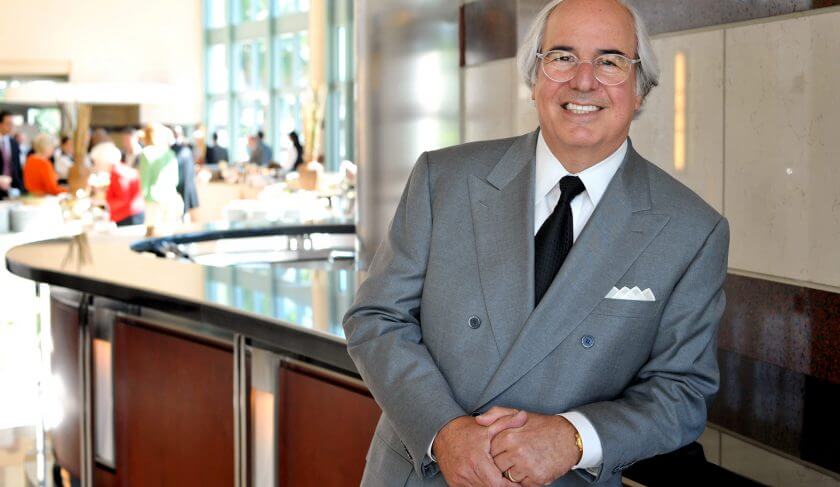

But don’t take our word for it. Here to dish on all the ways to stay safe from would-be scammers looking for any path into our lines of credit, finances, and lives, is Frank Abagnale, author of the book “Scam Me If You Can,” who knows all the tricks up scammers sleeves. Yes, THAT Frank Abagnale — about whom the iconic movie “Catch Me If You Can” was made.

Tune in to hear Frank open up about his journey into the FBI after he spent time in prison, and how the “love of country and love of character” that he saw exhibited by his fellow FBI agents rubbed off on him. Frank talks about what he really thinks of the movie (and subsequent Broadway musical by the same name) made of his life, and just how many times he’s really seen them.

Frank dishes on his new book, “Scam Me If You Can,” and what inspired him to write it. You may find some of the statistics he unearthed just as shocking as he did. For example, Millennials are scammed more often than seniors, but seniors lose more money because they have more money to be stolen.

Frank shares thoughts on why people may not be willing to admit when they’ve been scammed, and why that’s one of the worst instincts they can have. (Hint: Failing to go to law enforcement simply means that your scammer is still out there looking for other victims!)

He also educates us on some of the more common scams out there, including grandparent scams, sweepstakes scams, and romance scams, all of which he says have two things in common: 1) At some point, you’re going to get a request for money, and 2) At some point, the person you’re in contact with is going to ask for your personal information, including a birthdate, social security number, credit card number, or a credit card security code.

Frank talks about how easy it is these days to manipulate a caller ID to display whatever you want, including “US Treasury” or “Social Security Administration,” and how scammers are getting increasingly good at creating emails that look authentic, using personal information they’ve pulled from social media. Frank says that more than 5,000 phishing emails are received per day in the United States, with about $12 billion stolen per year. “If you tell someone where you were born and your date of birth, that’s all they need to know,” he says.

He also discusses the dangers of answering robocalls as well as robo texts, and the increasingly common “romance scams” (sometimes called “dating scams”) that resulted in $140 million stolen in 2018 alone. Frank also discusses his podcast with AARP, “The Perfect Scam,” which profiles America’s biggest scam stories, and talks about some of the ways women may be more vulnerable to falling victim.

In Mailbag, Jean and Kathryn talk about ESG funds, and how to know if your money is truly making an impact, and they answer a question from a listener about gaining access to her old frequent flyer miles and other credit card points that she fears her ex is using. We also tackle several questions from a new couple looking to get their life together started off right by negotiating for bonuses and relocation fees, and saving up for a down payment on a house. Lastly, in thrive, Jean discusses how we can all get waivers for things like late payments and annual fees, and the “secret sauce” for convincing customer service reps to give you what you want.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Frank Abagnale: (00:00)

You can’t rely on the police. You can’t rely on the government. You can’t rely on the bank to protect you. You have to be a little smarter consumer today, just like you have to be a little smarter business person today. And if you make it easy for someone to steal from you, and it’s very unfortunate, but the chances are someone will.

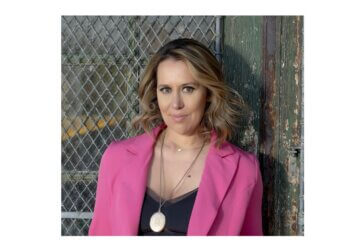

Jean Chatzky: (00:22)

HerMoney is sponsored by Fidelity Investments. We want you to feel confident about investing so that you can make your money work just as hard as you do. Learn the ropes without the jargon at fidelity.com/demandmore. HerMoney comes to you through PRX.

Jean Chatzky: (00:47)

Hey everybody, it’s Jean Chatzky. Welcome to HerMoney. If you own a cell phone, which I’m pretty sure everyone listening to this podcast does – in fact, you might be listening to this podcast on your cell phone – then I’m sure you are no stranger to spam calls. These days it feels almost as if robots call us more than real people do. But robocalls, as they’re known, are not the only way that we are getting spammed and scammed these days. Identities are being stolen every single day. Credit card numbers are swiped. Fraudulent activity pops up on statements left and right. Con artists, who are constantly trying to break through barriers to get their hands on our personal information, seem to be succeeding at every turn, which is why we have to take extra steps to ensure our own safety, particularly when it comes to our identities and to the easily hackable technology that we use on a daily basis. Fortunately for us, Frank Abagnale is in the house. As many of you probably know, Frank is a former con artist himself who had turned the corner and has now been helping individuals and corporations keep themselves so much safer for years. He is the author of Scam Me If You Can. He is an AARP ambassador and he knows all of the tricks that scammers have up their sleeves. Frank, thanks so much for being with me.

Frank Abagnale: (02:32)

Thank you for having me, Jean. It’s a pleasure.

Jean Chatzky: (02:34)

It is my pleasure to have you. Congrats on the new book.

Frank Abagnale: (02:39)

Thank you.

Jean Chatzky: (02:39)

So many people left you at the end of Catch Me If You Can, the movie, or the end of Catch Me If You Can, the Broadway show. How did you go from con artist to security expert? Just give us a very quick tour over the last 40 years.

Frank Abagnale: (02:59)

Well, as you know, at the end of the movie it mentions that the FBI took me out of prison on the condition I go to work for the Bureau as part of my parole and for the remainder of my sentence actually had been completed. And so I agreed to do that and got out of prison and have spent the last 43 years with the FBI, teaching at the FBI Academy, out in the field for our National Academy and of course for many, many law enforcement agencies around the world as well. I have to be honest that I think,, you know, when I came out of prison, I don’t want to say that I was a totally different person. I don’t think that prison rehabilitated me. I don’t think I saw the light there. I saw that as an opportunity. But once I had gotten out of prison, you’re surrounded by the most incredible individuals, their ethics, their character, their love of country, their love of family. That kind of rubs off on you. And of course, I met my wife 43 years ago on an undercover assignment. I didn’t have a dime to my name, but I eventually asked her to marry me and against the wishes of her parents, she gave me three beautiful sons, one who is an FBI agent today and been in the Bureau 14 years himself. It’s just been, those are the kinds of things that really changed my life.

Jean Chatzky: (04:22)

Have you seen the Broadway show and the movie multiple times? I mean, I got to tell you, along with Moneyball and When Harry Met Sally, and maybe You’ve Got Mail when Catch Me If You Can, comes on, I’m watching. Even though I know exactly what’s going to happen.

Frank Abagnale: (04:39)

I’ve seen the movie just twice. I love the movie Steven Spielberg. You know, he made the movie because he loved the redemption side of the story. And I truly loved the play. I saw the play several times performed by high school students, performed by colleges or community theaters and of course many times on Broadway. And the music written by Marc Shaiman and Scott Wittman who did Hairspray. They did a great job of just telling the same story but putting it to music and making into a Broadway musical. And I really have enjoyed the play as well.

Jean Chatzky: (05:10)

Amazing. Amazing. So the new book, what happened in recent years that juiced up this activity in the world of scams that made you think it’s time to put pencil to paper or pen to paper or your fingers to the keyboard again?

Frank Abagnale: (05:28)

Well, you know, prior to that I’ve written four other books, but they’ve always dealt with commercial crimes and crimes against the federal government and crimes against financial institutions. And about five years ago I started working with AARP and which has been a great experience. So I started dealing more about consumer-related crimes and AARP actually commissioned me to write that book. It’s actually their book, published by Random House, but it belongs to AARP books and they commissioned me to write it. But what was interesting, they said to me when they did so that I want you to cover every scam. I want you to cover scams about millennials. I want you to cover scams about seniors. I want you to cover scams that would involve investment bankers, crypto currency, Bitcoin. And so that’s basically what I set out to do. And I was amazed by some of the things I found when researching for the book. For example, I realized that millennials are scammed more often than seniors.

Jean Chatzky: (06:26)

I read that.

Frank Abagnale: (06:27)

Yeah, but seniors lose more money because they have more money. But I also realize, you know, and I tell people all the time, anyone can be scammed. The most intelligent people have been scammed. I know that I can be scammed. I’m well aware that I can be scammed. But you have to tell someone if that occurs. And sometimes people don’t want to tell anybody because they’re afraid if they’re elderly person that someone may then want to take away their check writing privileges or money privileges. And sometimes they’re embarrassed because they fell for a scam. But there’s nothing to be embarrassed about. Anybody can be scammed. The important thing is that you tell a loved one or you tell someone that you know or law enforcement so that they don’t keep doing it to someone else.

Jean Chatzky: (07:13)

If anybody can be scammed, what are the best defenses that we can put in place to protect ourselves broadly?

Frank Abagnale: (07:23)

Well, you know when doing this book and then you’ve finish writing and I literally covered every scam there was up until now, all types of scam, the grandparent scams, the sweepstakes scams, the robocalls, all the different scams and unfortunately every day there’s a new scam, but what I realize is they all have one thing in common and that is there are two red flags and if you learn these red flags, most of the time, 99% of the time you will not be scammed. And the red flags are pretty simple. At some point, I’m going to ask you for money, no matter how the call started or the email came in or the romance scam that went on for a year, with a relationship with someone, at some point I’m going to say and ask you for money and I’m going to tell you the money needs to be immediate. You need to wire me the money. you need to give me a credit card over the phone. You need to give me your bank account number so I can draw against it. You might need to go down to Walmart and get me a green dot card. Then read me the number on the back of it so I can get the money. Everything has to be right now immediately. And the other red flag is that at some point in the conversation I’m going to ask you personal information, your social security number, your date of birth. For example, I might have the caller ID ring and it says it’s your bank. It’s very easy to manipulate the caller ID. I can make it say whatever I want it to say. Police department, US treasury, Medicare, IRS and I’ll get you on the phone and after a few minutes everything’s fine until I start to say to you now just to verify that you have your credit card in your possession, can you read me the three digits on the back of the credit card and that’s that red flag. You have to realize I didn’t solicit that call. They called me. I don’t really know who’s on the other end of that phone line, so I’m not going to give anyone that information and that’s where you hang up. You turn the credit card over, there’s an 800 number on the back, you call the credit card call center and you simply say, I got a call. They said they were from the bank security department, started asking me a lot of questions. I was uncomfortable with that and they’re of course going to tell you that was not us. We would have never asked you those questions and that was probably a scam call.

Jean Chatzky: (09:38)

It sounds like very good basic advice. I want to dig into some of the specifics about the particular scams that you cover in this book and the particular nuisances. But before I also want to ask, you said seniors lose more money because they have more money, but millennials are scammed more often. Why is that?

Frank Abagnale: (10:00)

Because they’re so trusting. They believe that it’s okay. You know, we live in a way too much information world, so to give you a good example of that, we have about 5,000 phishing emails a day. I get to see a lot of them cause I use them in class at the Academy and when I see them a couple of years ago they had misspelling the grammar was poor and you could really kind of realize this can’t be legitimate. Now when I see them, they would read more likely to say, good morning Joan, great having lunch with you yesterday. We need to do that more often. I hope you and your husband Randy, have a great time at Disney World this week. When you get back, please give me a call and we’ll have lunch again, signed Barbara. What happens is the scam artists now go to social media where she already said her husband’s name several times. She said her children’s name, she said that she had lunch with her friend yesterday. They’re making these emails sound so real and so timely that you think this absolutely must be them. So they’ve gotten much more sophisticated and we get about 5,000 phishing emails a day in the United States, about $12 billion is stolen through phishing emails. And when we track that money, we find it literally goes out to more than 115 countries around the world. So we know a lot of those phishing emails aren’t even generated here in the United States. So they’re getting a little more sophisticated. We tell people way too much about us. You know, I always tell people, I’m not on social media of any kind, but I’ve always told my children, if you’re on Facebook and you told somebody where you were born and your date of birth, that’s 98% of them stealing your identity. That’s all they need to know. So these are the kinds of things you don’t want to do. But millennials think that, well, no, I don’t see any harm in doing that and are giving information. I’ve found that they fell a lot for these scams, which seniors didn’t fall for and that was when they’d be on their computer and a pop up came up said we detected malware on your computer, please call Microsoft.

Jean Chatzky: (12:07)

I fell for that one.

Frank Abagnale: (12:09)

Yeah. And a lot of these scams I know that I would fall for. You know, for example, let me just very briefly tell you one that’s going around. Now you get your credit card statement from Visa, MasterCard, American Express, whoever it is, and you notice there’s a charge on there. Not much, $82, but you don’t recognize the company. So you call the credit card company and you say, hey, I don’t understand who this merchant is. It says $82. I don’t recall making this purchase. And they tell you , well you’ll have to call them. Let me provide you with their phone number. And then you call that number and they’d say, Oh, you know, we’ve been having trouble with our software, so that could very well be a mistake on our part. So can you just read me your credit card number and the information, your name, what bank, etc.? It’s just another way of getting information from intercourse. Setting up a merchant account with a credit card company is one of the simplest things to do. So if you and I were going to start selling something on the internet, we could easily set up a merchant account and say we’re a merchant,

Jean Chatzky: (13:13)

But, why wouldn’t Visa, MasterCard, American Express, why are they going to make me call? Why wouldn’t they call for me?

Frank Abagnale: (13:21)

Well, because they say they don’t know, they have the company, they know it’s a merchant of theirs, but they don’t know the particulars about why they charged you or whatever was and they ask you to take it up with them. Sometimes the merchant’s number is actually printed on the statements, but if they don’t, then they’ll, they’ll provide you with the number. But it’s just another scam. And it all comes about getting information from you and getting something from you, whether it be personal information or it be money.

Jean Chatzky: (13:50)

That’s unbelievable. I mean, it’s so hard to shut it down at every turn, but that’s exactly what we’re going to try to do after I remind everyone that HerMoney is proudly sponsored by Fidelity Investments. You don’t have to know all the answers when it comes to your financial future, but an important question to ask yourself is what you want from your money. What are your financial goals? No matter where we’re meeting you on your financial journey, Fidelity is here to help you reach your goals faster. It all starts with a financial checkup and an understanding of what you own and what you owe. From there, the folks at Fidelity will work with you to evaluate your investment options and different ways to grow your savings. Discuss your goals, see where you stand and get help taking the next steps at Fidelity.com/demandmore. I am happily talking with Frank Abagnale, cyber-security expert, author of Scam Me If You Can. We were talking about theft and scams broadly. Now let’s talk about a few specifically, and I’d love to know if you have any advice for, for shutting these things down in their tracks. First are robocalls, which are showing up not just on our landlines anymore, but on our cell phones. Is there anything we can do?

Frank Abagnale: (15:11)

We’re making a little progress there in that a few months ago, the government deregulated, some of these phone companies to give them the ability to identify those calls so that when you have for example, a call come in, it will tell you on the call, whether it be on your iPhone or be on your land phone, that it is in fact a scam call. And they know where these calls are directed from. Only about 30% of robocalls actually come through the major phone companies like at AT&T and Verizon. They’re coming from these hundreds and hundreds of independent phone companies all over the world, like down in Jamaica and places like that where they’re making so many cents on every call. And a lot of that is not very well regulated, but they are able to detect that those calls are coming from a source that is recognized as a scam call or someone that might be trying to get information out of you. So you notice more and more now on your phone that a phone number will ring, but it will come up and say, potentially a scam call. And those you don’t want to answer. Now, the only thing that concerns me about this is that the more we control and shut down the robocalls, we’re going to move, no question about it, to their evil twin, which is the roboscam, text messages, where I text you and ask you something and get you to respond to my texts.

Jean Chatzky: (16:36)

What are the hallmarks of a robotext?

Frank Abagnale: (16:38)

You know, I will text you and say that this is American Airlines and I’m checking to see if you’re still confirmed on this flight. It can say anything, it’s getting you to respond to that text. And if it’s not something you’re familiar with or something that you recognize as someone that you want to receive a text from, you shouldn’t respond. Sometimes they send you a text and say, link here to see this photo or this message. You just have to be careful of them. You know, somebody once asked me, and this was very fascinating doing the research for this book. They said, how do these people know when they make robocalls that the person they’re calling maybe is in fact a senior or someone that’s 70 or 80 years old. Well you know when I was a kid and you went to the phone book, the only thing the phone book told you was the person’s name, their address and their phone number. But if you go to whitepages.com, it not only tells you the person’s name, it tells you the person’s age. They tell you their wife’s age. They tell you if they have siblings or relatives living with them. Then if you use simple software to break down zip codes, you can literally go to predominant neighborhoods where there maybe is a little more wealthy people, and then you start calling those calls. You know that the person that’s going to answer it is someone that is a little older, maybe 70, 80 years old, and that’s how they know. We live in this so much information world that people just take advantage of us. And I think that’s the biggest problem we have.

Jean Chatzky: (18:14)

You mentioned romance scams, dating scams. We had a woman on our podcast named Abby Ellin who wrote a book called Duped, where she fell for one and she wasn’t alone. The FDC reported more than 21,000 cases of relationship scams in 2018 alone. There was more than $140 million that was lost. And we know a lot of people don’t report them because they are embarrassed. So how do we guard against these?

Frank Abagnale: (18:43)

Again, you know, this is, you know, I do a podcast as well for AARP out of their studios in Washington called The Perfect Scam. And basically we find people that have been scammed. We send a researcher out to talk to them. And I’ve had so many of them that are romance scams, which have almost doubled. When I was writing the book they increased twice over. By the time I had finished the book, they’re becoming very popular. But what you find there is someone meets someone online. In this one particular case, this was a woman in her mid-seventies, she had lost her husband a few years ago. She was kind of lonely. She met somebody online. She started talking with them on the telephone. And this went on for a year and nothing was ever asked for. It was just nice conversation. He would call her. She would call him. They would send text messages, emails back and forth. And then one day she finally said, listen, Bob, if you only live a couple of states away from me, why don’t you come see me? Well, you know, I would, but I have to have this operation and I really don’t have the money. And you know, it’s $30,000 and I don’t even know if I’ll make it without the operation. Well, you know, I could loan you that $30,000. And in this particular case, this woman ended up giving him over $178,000.

Jean Chatzky: (20:06)

Wow.

Frank Abagnale: (20:06)

But then when we went down to find out who this person was, it turned out to be a gentleman over in Greece who didn’t even have a passport, never been to the United States. But as I explained to people, these scam artists that do that, you’re not just one person they’re concentrating on. They’re concentrating on 20 people. So they’re having these conversations over that 12 months with 20 different people. So they’re just coming back to you. They have notes and everything about what you talked about last time if they haven’t recorded it. And they’re just coming back. So once again, if you meet someone online or you have a conversation with someone or involved in a romance with someone, if you’ve never met them, then again, you have to wait for that red flag and watch out for that red flag. If at some point they start asking you personal information like well where do you bank or what’s your credit card number or what’s your social security number? What is your date of birth? Those kinds of things. Then you have to say, well, I’ve never really actually met this person. I’ve only talked with them on the phone or met them online. You don’t want to give out that information whether it’s been going on for a year, two years, three years. That’s the red flag. When that comes up, that’s when you need to start asking yourself, do I really know this person?

Jean Chatzky: (21:30)

Are women more vulnerable?

Frank Abagnale: (21:33)

Well, you know what? One of the scams going on now is they searched these Facebook pages and they find a young Marine on there who’s a Lieutenant, highly decorated, very good looking. They snatch his picture off the Facebook page. Then they send out thousands of emails to women saying that that’s them and starting a conversation with them or romance with them and eventually they’ll say, I’m over in Afghanistan. Could you send me some money or could you send me a gift cards with some money on it so I can… And it’s just another way to get money. So I would say men certainly could be scammed by women, but it tends to be a lot more of men scamming women and they don’t need to be elderly women. They can be anybody liking this particular scam that we had with the Marine picture. That Marine had his picture all over the world. He didn’t even know they were using his picture and still women started tracking him down under his real name and he said, I never sent you an email. I don’t know what you’re talking about. I never sent you my photo and realized that someone else was doing that.

Jean Chatzky: (22:41)

Oh boy. Before I let you go, there are many of us who are not just looking out for ourselves. We’re looking out for our parents. We’re looking out for our children. Is there anything special we should be doing to protect our families on a larger scale?

Frank Abagnale: (22:55)

Almost every person who has told me so far, they read the book and said, you know, when I finished your book, I went and bought four copies for my parents and my in-laws because this is something they really need to read. And I think if you just need to educate yourself about these things, you can’t rely on the police. You can’t rely on the government. You can’t rely on the bank to protect you. You have to be a little smarter consumer today. Just like you have to be a little smarter business person today. And if you make it easy for someone to steal from you, and it’s very unfortunate, but the chances are someone will. So you need to kind of educate yourself and make sure that you understand how these scams work. And so that when you get that call or you get that email, or you’re involved with someone on the phone that you never met, you’ll be able to go back and say, no, I think this is a scam. I’ve read about this, I’ve heard it on HerMoney, and I now know what that’s all about. I’m not gonna fall for that. But you know, you have to do that. You have to educate yourself and if you do that, you can protect yourself from a lot of things happening to you,

Jean Chatzky: (24:03)

Frank Abagnale. It’s always a pleasure. Thank you so much for doing this.

Frank Abagnale: (24:06)

Thanks Jean for having me. It was a real pleasure.

Jean Chatzky: (24:08)

Absolutely. And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (24:20)

HerMoney’s Kathryn Tuggle has joined me in the studio. He’s so calming to talk to that you forget that he’s talking about all of these really sketchy things.

Kathryn Tuggle: (24:33)

Right. I think that’s probably why he was successful as a con artist.

Jean Chatzky: (24:36)

I think that probably is. You also forget how young he was.

Kathryn Tuggle: (24:41)

Crazy.

Jean Chatzky: (24:41)

I mean, I watched that movie again recently cause I do watch it every time it’s on television and he was just a baby. Just a baby. So smart.

Kathryn Tuggle: (24:50)

But I think you have to be, right? Because you don’t know what you don’t know.

Jean Chatzky: (24:54)

Yeah.

Kathryn Tuggle: (24:54)

The world is just limitless possibility.

Jean Chatzky: (24:57)

Unbelievable. The two things I took away from this and there were many more great ones, but we all live so much of our lives on social media. And I once sat with a security expert, not Frank, but somebody else who said, I checked you out before we met for coffee and I know that your kid goes to this college and they have dogs named this and this and this and you live in this town. And you took a trip here and just laid out my whole life. And every potential security question that a site might ask me to answer was up there. And I think I’m smart about this stuff, but we all, and our kids all just share way too much.

Kathryn Tuggle: (25:45)

It’s true. And you know, one thing I thought about when my grandmother passed was obituaries reveal so much.

Jean Chatzky: (25:52)

Oh my God. I mean the goal is either to hide in a cave or to freeze your credit, which we did not talk about during that segment. We’ve talked about it with Frank before. I just think freezing your credit is an absolute must these days. And yes, you have to lift the freeze before you apply for credit on your own and yes, you have to freeze your credit with each of the three credit bureaus individually. But I’ve frozen and lifted the freeze several times now. It is so far from being a pain in the neck. It’s just nothing.

Kathryn Tuggle: (26:27)

Right. It’s very easy. I just had to do it to get a mortgage. Now everyone knows I have a mortgage.

Jean Chatzky: (26:31)

It’s true.

Kathryn Tuggle: (26:32)

More details…

Jean Chatzky: (26:32)

But we do have to be more careful and I also was thinking sometimes on my caller ID on my landline, it comes up and it does say spam. It doesn’t say scam. It does say spam. I don’t know why I feel compelled to answer the phone anyway. I always pick up the phone. I’m just such an idiot. I’m not going to pick up the phone. I think letting the phone ring is hard for me.

Kathryn Tuggle: (26:59)

I hear you. I feel almost like heading them off because I don’t want them to leave me a voicemail.

Jean Chatzky: (27:04)

No.

Kathryn Tuggle: (27:04)

So I feel like it’s more proactive to pick up, which is probably the wrong instinct.

Jean Chatzky: (27:09)

I pick it up, I hang it up. And I never check voicemail anyway on any phone as you know, so there we go. All right. What do we have in mailbag?

Kathryn Tuggle: (27:21)

Our first note comes to us from Linda. She says, I’ve recently received from extra funds to invest and I’m very interested in putting a portion into ESG funds. I enjoyed your recent conversations about this, but I haven’t heard you discuss third party verification of ESG labels. There’s some chatter that there needs to be closer monitoring of the funds operating under the ESG label. I’ve heard it said that many corporations, sustainability directors are more beholden to marketing departments than they are to operations and that the ESG efforts of any given company are not held to the same standard as the financial reports. In other words, some companies could be misleading investors about the ESG efforts they’re making and the goals they’re meeting. Having worked for the US government for 30 plus years on climate and clean energy issues, I am especially attuned to fluff over substance and don’t want to invest in less than honest companies or funds.

Jean Chatzky: (28:13)

Linda has a point. And it was reminding me listening to this question… When I was a young reporter at Forbes years ago, I wrote a story about how a variety of mutual funds were being marketed as quote unquote retirement funds. They put retirement front and center in their title and when you dug into the portfolios of these funds, the investments of them, many of them were not at all suitable for retirement and that’s exactly what’s going on here. There is a lot of marketing. This is a hot category and there are a lot of different classifications too. We talk about socially responsible investing. We talk about impact investing. We talk about ESG, which stands for environmental, social governance. There’s a lack of consistency across those categories and not a lot of agreement about what the various terms necessarily mean. So the answer, because there’s not a lot of vetting going on these days is that Linda, you gotta read the prospectus. And not enough of us actually dig in and read the prospectus or the other documentation to figure out exactly what is held in our funds. I would also point you to Morningstar. Morningstar for years has just been a wonderful, valuable resource for all sorts of mutual funds and they are, once again, a valuable resource for these sorts of funds. But you’re totally right. There are some that are better than others, just like there are some target date funds that are better than others and some index funds that are better than others. You got to look under the curtain.

Kathryn Tuggle: (29:59)

Great advice. Our next letter comes to us from Cynthia. She writes, I’m recently separated from my husband and for years I was listed as an authorized user on all of his credit cards. He has removed my name from all of the accounts. Of course I can’t use the cards as I could prior to the separation, but I find I’m also locked out of using any of the rewards I spent years accumulating. I tried getting myself added back as an authorized user on the accounts so I could at least check on the benefits accumulated. But I have been prevented from doing so by the credit card companies. I assume there’s nothing that can be done here, but I wanted to ask for your advice. If I am at an impasse, then I’d like to see some reform in the credit card industry on this front. I’m very responsible with my money and have no debt.

Jean Chatzky: (30:42)

So first of all, Cynthia, I’m sorry for everything that you are going through having been through a divorce myself. I know that these are very, very stressful times, so I hope that you’re taking care of yourself and being kind to yourself. These frequent flyer miles are in many cases treated as a marital asset. So when you talk to your lawyer, and I hope you have a lawyer, about the division of property, these miles should go on the list. I understand that technically they’re in your husband’s name, but as they’ve been accumulated as an asset during your marriage, just like a retirement account that’s in your husband’s name, they may be looked at as a similar marital asset and you may be able to get your share of those. And I would do this relatively quickly because as I see it and I’m not a lawyer, the risk is that your spouse blows through all of these miles while he’s able to do that before you have the ability to get your hands on them. So heads up to the attorney and, you said you’re recently separated, if you have yet to file for divorce, and again, I’m not a lawyer, but my understanding is you have to file to start the clock on these things and to freeze things in position. This is just a reason to do that sooner rather than later.

Kathryn Tuggle: (32:16)

Great advice. Our last question comes to us from Megan. Hi Jean. I love the podcast.

Jean Chatzky: (32:22)

Thank you.

Kathryn Tuggle: (32:23)

I think you do a great job of keeping things relatable and down to earth. I’m finishing up grad school this coming spring and will be looking for full time employment in June. I’m fortunate to be graduating debt free with about $19,000 in savings and my partner has around $16,000. We have two goals for the future, buy a home and get great jobs. My questions are, do starting bonuses or relocation packages still exist. Is it reasonable to think that we should tap out our savings thus leaving ourselves with very little in the way of an emergency fund in order to afford a down payment? Also, how important is it to be able to put down the full 20% for a down payment? My partner and I will hopefully have a combined household income in the neighborhood of $150,000. Thank you so much.

Jean Chatzky: (33:07)

Thanks so much for writing Megan and congratulations on your upcoming graduation. It sounds like you are doing incredibly well. I would approach this step by step. I would work on getting the jobs first. That’s the only way that you’ll know where you’re going to be. And so that’s the first step that makes sense in figuring out where you actually want to buy that home. Starting bonuses and relocation packages do still exist in some industries, not in all industries, but you’ll want to listen to our show with Tracy Keough if you haven’t listened to it already because she lays out how to ask for those things in very specific ways. Also, in terms of the amount that you have to put down on a home, you don’t necessarily have to put down 20%. It does depend on where you’re looking and if you’re buying a specific sort of apartment where the down payment requirements are higher – in a co-op or a condo, they may be. But the benefit of putting down 20% is that then you don’t have to pay private mortgage insurance, which can add anywhere from a couple hundred dollars and up to your monthly cost of living. So if you can get around that, that’s a good thing. I would probably table the buying a home for sort of six months until you’re settled enough to know that you’re happy where you are, that you’re both happy enough in those jobs to want to stay in that town, in that field for the long haul and that you’re going to be there for a good five years. At that point I’d start looking for a home and at that point your cash cushion is likely to be bigger than it is now, which may enable you to put down that full 20%. I wouldn’t completely eliminate your emergency fund because as a homeowner I can tell you that a home is often the source for which you have to drain that emergency cushion, or at least use part of it to fix a roof or fix something else that comes up unexpectedly. But it sounds like you are embarking on a wonderful journey and I wish you all the luck in the world. Thank you so much for writing. And Kathryn, thank you.

Kathryn Tuggle: (35:30)

Thank you Jean.

Jean Chatzky: (35:31)

Absolutely. In today’s Thrive, how do you feel when that annual fee hits your credit card statement once a year? How about those late payment fees or those balance transfer fees you’d like to ditch them? Right. Well new research from Wallet Hub shows, it’s possible you just have to ask. Of the 46% of people who asked to have a late payment fee waived, 41% were successful. Of the 26% who asked to have an annual fee waived, 17% were successful and of the 10% who asked to have a balance transfer fee waived, 7% heard a yes. The key to succeeding is asking. The reluctance to speak up is likely one big reason, men were twice as likely to get those annual fee waivers as women. And second, don’t be persnickety, presumptuous or rude. Be polite. More than 60% of survey respondents said simple niceness was the key to getting what they wanted. In other words, minding your manners goes a long way when dealing with people who may have grown accustomed to getting yelled at all day. Perhaps not surprisingly, only 2% of survey respondents said screaming and yelling was key to their success.

Jean Chatzky: (36:55)

Thanks so much for joining me today. On HerMoney. Thank you to Frank Abagnale for coming back and visiting with us another time with another great conversation. We always love his advice about keeping ourselves safe in the virtual world. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts. Leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by video helper and our show comes to you through PRX. Join me next week as well. I am very excited to tell you we’ve got chairman and CEO of Fidelity Investments, Abby Johnson. We’re talking about career growth, female investors, risk tolerance, and much, much more. Thanks so much for joining me today and we’ll talk soon.